[EDRM Editor’s Note: This article was first published Aoril 2, 2023 and EDRM is grateful to Rob Robinson, editor and managing director of ComplexDiscovery, for permission to republish.]

ComplexDiscovery Editor’s Note: Since beginning in November 2001 to track the number of publicly highlighted merger, acquisition, and investment (M&A+I) events in the eDiscovery ecosystem, ComplexDiscovery has recorded 540* M&A+I events.

While not all-inclusive due to the fact that M&A+I events are not always publicly disclosed and some announcements may not represent event completion, the abridged listing of M&A+I events maintained by ComplexDiscovery notes key industry events by sharing event date, company involvement, and known event amounts.

Industry Update

eDiscovery Mergers, Acquisitions, and Investments in Q1 2023

ComplexDiscovery

Overview of Q1 Merger, Acquisition, and Investment Activity in the eDiscovery Ecosystem (Q1 2023)

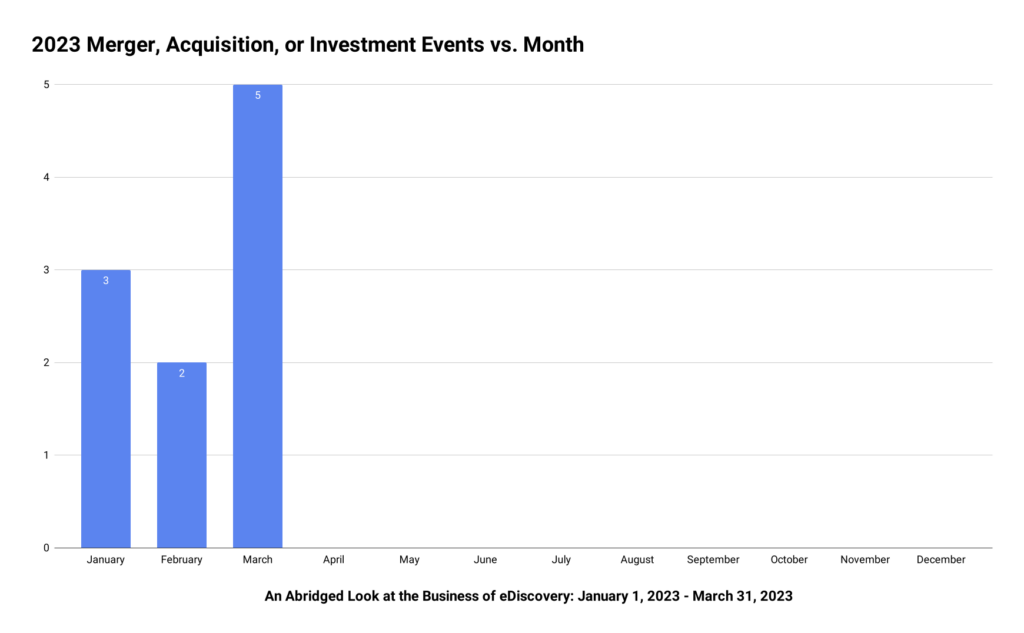

In Q1 of 2023, the eDiscovery ecosystem experienced a total of 10 merger, acquisition, and investment (M&A+I) events. The monthly distribution of these events is as follows:

- January: The eDiscovery ecosystem kicked off the year with 3 M&A+I events in January. This modest start indicates a certain level of activity within the sector.

- February: In February, there was a slight decrease in M&A+I activity, with 2 events. This decline could be attributed to various factors, such as seasonal trends or market conditions.

- March: The eDiscovery ecosystem experienced a surge in M&A+I activity in March, with a total of 5 events. This upswing in activity could be indicative of an increased interest in the eDiscovery market or the emergence of new opportunities and partnerships.

The first quarter of 2023 saw a moderate level of M&A+I activity in the eDiscovery ecosystem. The fluctuation in the number of events from month to month may be due to multiple factors, including market conditions, economic trends, or the impact of specific industry-related events. Nevertheless, the ecosystem remains dynamic and responsive to the evolving landscape of digital data management and legal technology.

In Q1 2023, the eDiscovery ecosystem experienced a range of merger, acquisition, and investment activities, with a total of 10 events occurring. The events are as follows:

- On January 19th, Exterro acquired Zapproved.

- On January 20th, Thoma Bravo acquired Magnet Forensics for an estimated $1.3 billion.

- On January 31st, Open Text acquired Micro Focus for approximately $5.8 billion, including Micro Focus’ cash and debt, subject to final adjustments.

- On February 2nd, HBR Consulting acquired Younts Consulting.

- On February 16th, AlixPartners acquired THM Partners LLP.

- On March 6th, Trustpoint.One acquired inWhatLanguage.

- On March 13th, TransPerfect acquired Jet Export E-Discovery, gaining JetSuite Legal Technology Tools in the process.

- On March 15th, NewField Capital Partners converted their investment in iCONECT to equity.

- On March 20th, Reveal acquired LIGL.

- On March 20th, Teris, Elijah, Meta-e, and Modus formed a strategic partnership with Repario (JLL Partners).

These events indicate a healthy level of activity in the eDiscovery ecosystem, showcasing a variety of acquisitions, investments, and strategic partnerships throughout Q1 2023.

Chart #1: An Overview of Merger, Acquisition, and Investment Events by Calendar Month (2023)

Overview of Q1 Merger, Acquisition, and Investment Activity in the eDiscovery Ecosystem (2020-2023)

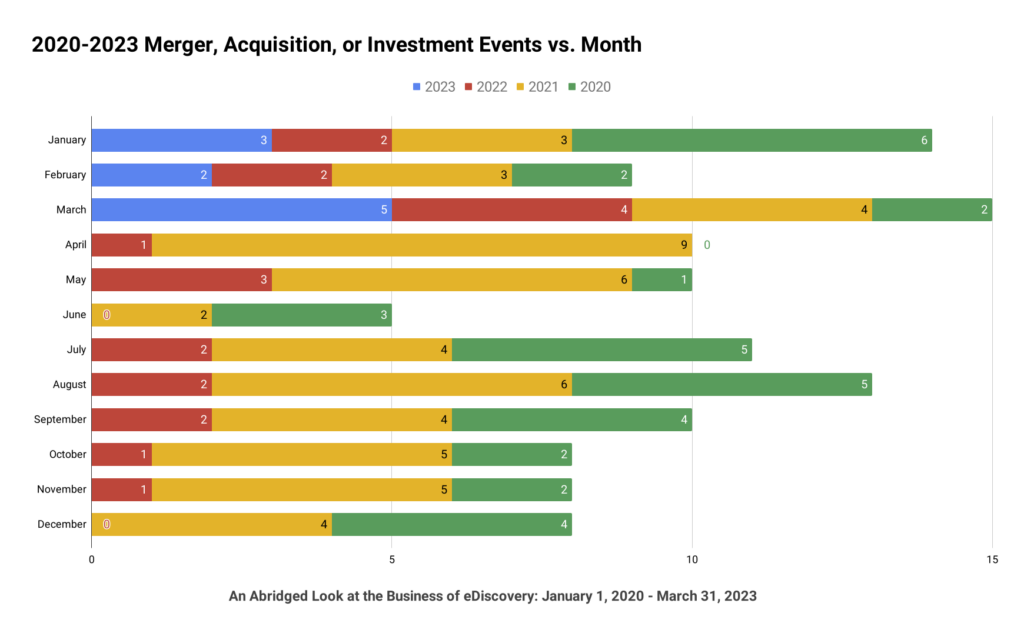

A comparison of Q1 M&A+I activity in the eDiscovery ecosystem over the years 2020 to 2023 reveals the following insights:

January:

- 2020: The eDiscovery ecosystem started the decade with 6 M&A+I events, reflecting a strong beginning.

- 2021: Activity remained relatively stable in January 2021, with 3 events.

- 2022: A slight decrease in activity was observed in January 2022, with only 2 events.

- 2023: The number of events in January 2023 returned to the same level as 2021, with 3 events.

February:

- 2020: February 2020 saw a decline in M&A+I activity compared to January of the same year, with just 2 events.

- 2021: The number of events increased to 3 in February 2021.

- 2022: M&A+I activity remained stable in February 2022, with 2 events.

- 2023: The eDiscovery ecosystem maintained the same level of activity in February 2023, with 2 events.

March:

- 2020: March 2020 saw a continuation of the downward trend in M&A+I activity, with only 2 events.

- 2021: There was a notable increase in activity in March 2021, with 4 events.

- 2022: M&A+I activity remained consistent in March 2022, with 4 events.

- 2023: The eDiscovery ecosystem experienced a surge in M&A+I activity in March 2023, with 5 events.

Q1 M&A+I activity within the eDiscovery ecosystem has experienced varying levels of activity over the years. The beginning of the decade saw a strong start, with fluctuations in subsequent years. The general trend indicates that the ecosystem has been recovering from the lows of 2020, with a notable increase in activity during March 2023.

Chart #2: 2020-2023 Merger, Acquisition, or Investment Events vs. Month

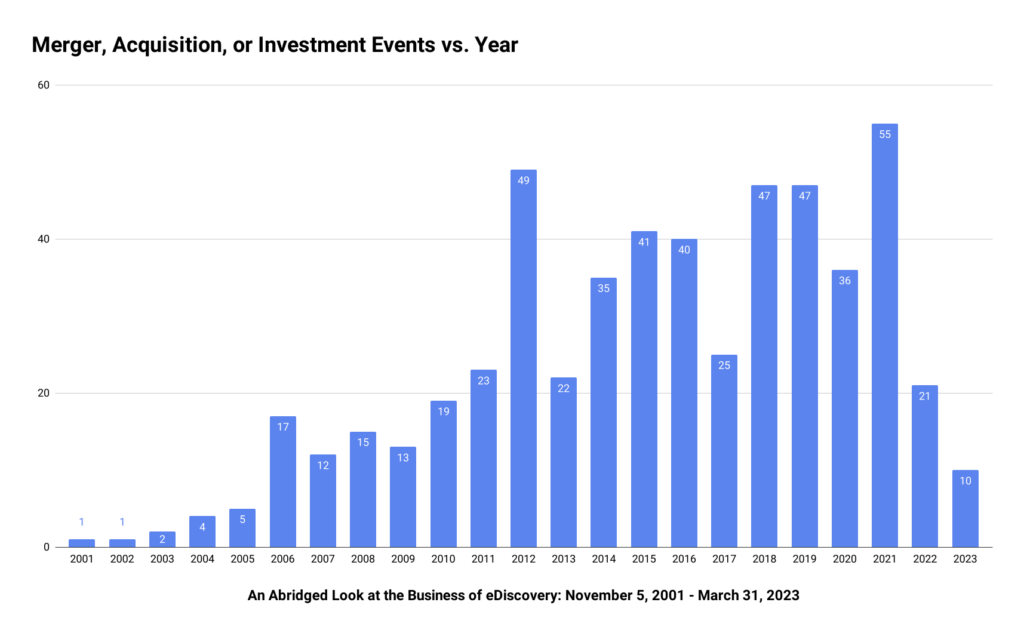

Overview of Yearly Merger, Acquisition, and Investment Activity in the eDiscovery Ecosystem (2001-2023)

The eDiscovery ecosystem has experienced fluctuations in merger, acquisition, and investment (M&A+I) activity over the years. Here’s a summary of the yearly M&A+I events from 2001 to 2023, with trends highlighted:

- 2001-2006: In the early years of the eDiscovery ecosystem, M&A+I activity remained relatively low, starting with only 1 event in 2001 and gradually increasing to 17 events in 2006. This period reflects the nascent stage of the eDiscovery industry.

- 2007-2009: The global financial crisis may have contributed to the reduced M&A+I activity during this period, with a slight dip from 15 events in 2008 to 13 events in 2009.

- 2010-2013: The ecosystem experienced a gradual increase in activity following the global financial crisis, with events rising from 19 in 2010 to 22 in 2013.

- 2014-2016: M&A+I activity saw significant growth during this period, with 35 events in 2014, peaking at 41 events in 2015 before slightly decreasing to 40 events in 2016.

- 2017: The year 2017 saw a substantial drop in M&A+I activity to 25 events, possibly due to market or regulatory factors.

- 2018-2019: Activity rebounded in 2018 and 2019, with a consistent 47 events each year, reflecting a stable eDiscovery ecosystem.

- 2020: The COVID-19 pandemic impacted global economies, leading to a decrease in M&A+I activity to 36 events in 2020.

- 2021: Despite the ongoing challenges of the pandemic, the eDiscovery ecosystem experienced a significant surge in M&A+I activity, reaching a peak of 55 events in 2021. This could be attributed to the increased reliance on digital tools and remote work, driving the demand for eDiscovery solutions.

- 2022: The M&A+I activity decreased to 21 events in 2022, which could be a result of market consolidation following the previous year’s peak or other economic factors.

- 2023: The data for 2023 is limited to Q1, with 10 M&A+I events. However, initial indications are for a strong year that should exceed 2021 activity and stabilize in the 30-40 event range.

The eDiscovery ecosystem has experienced varying levels of M&A+I activity over the years, with noticeable trends influenced by global economic factors, such as the financial crisis and the COVID-19 pandemic. The industry appears to be dynamic and adaptive, responding to changes in market demands and the increasing reliance on digital tools.

Chart #3: Merger, Acquisition, or Investment Events vs. Year (2001 Through 2023)

M&A+I Events (Running Listing: November 2001 – Today)