[EDRM Editor’s Note: This article was first published here on April 17, 2023 and EDRM is grateful to Rob Robinson, editor and managing director of ComplexDiscovery, for permission to republish.]

ComplexDiscovery Background Note: The quarterly eDiscovery Business Confidence Survey has been administered thirty times since early 2016, with 3,014 individual responses from eDiscovery industry professionals. The survey provides valuable insight into the current business confidence of cybersecurity, information governance, and legal discovery professionals in the eDiscovery ecosystem. Today ComplexDiscovery shares the observations and opinions of industry analysts and observers, reporters and communicators, and law firm and legal department experts and consultants on the eDiscovery business climate in the spring of 2023. The spring 2023 survey response period was initiated on March 25, 2023, and continued until April 14, 2023. The survey was highlighted and promoted primarily by direct email from ComplexDiscovery, the EDRM, and other leading eDiscovery organizations to cybersecurity, information governance, and legal discovery professionals.

This quarter’s survey experienced a strong* response rate, with 75 eDiscovery professionals sharing their opinions on the business of eDiscovery. While individual answers to the survey are confidential, the aggregate and unfiltered results are published to highlight the business confidence of participants regarding economic factors impacting the creation, delivery, and consumption of eDiscovery products and services during the spring of 2023. These results may be useful to legal, information technology, and business professionals seeking to better understand current and potential future business conditions as shared by survey participants.

Industry Survey

The Spring 2023 eDiscovery Business Confidence Survey Results

Final Results

Spring Survey Results Summary

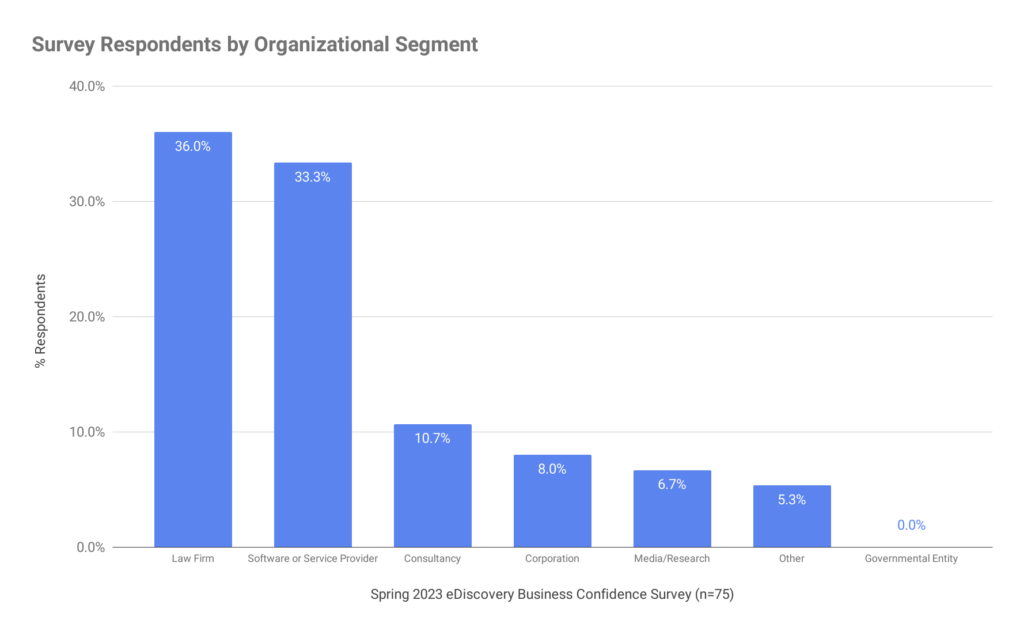

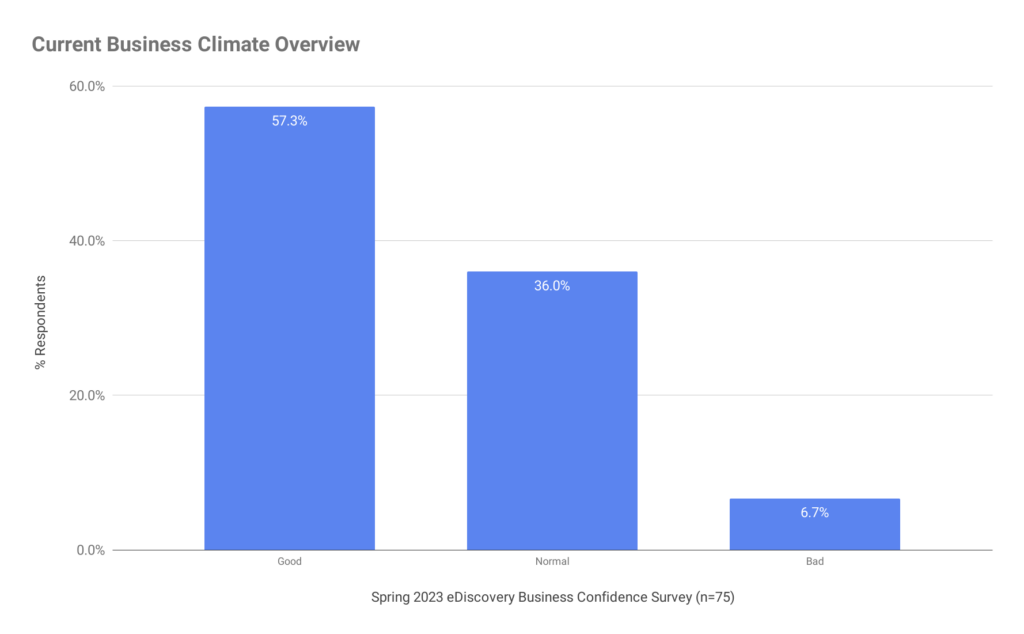

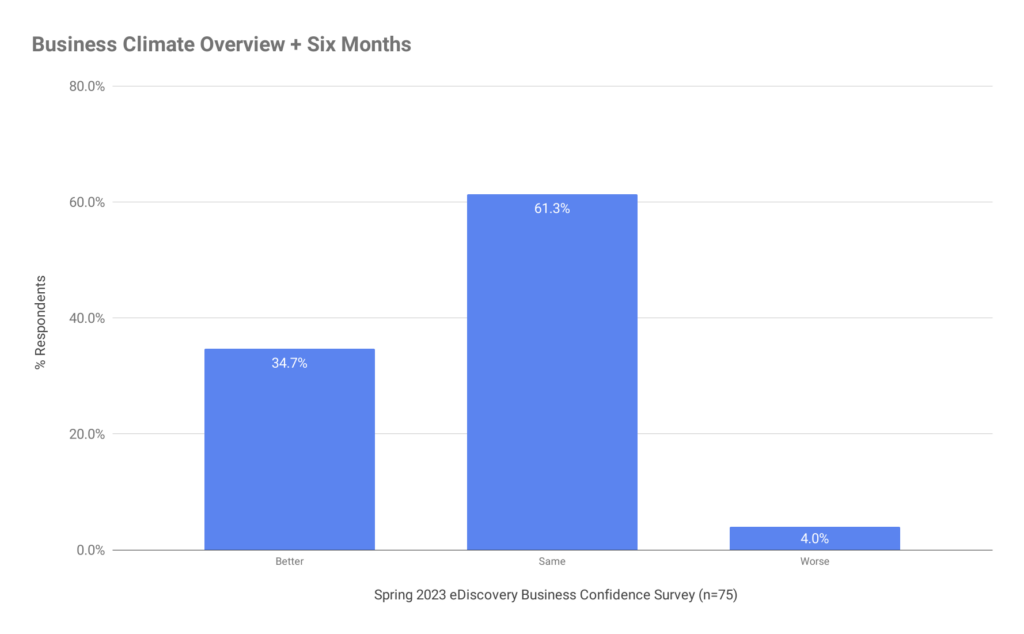

The eDiscovery ecosystem is diverse and continuously evolving, as demonstrated by the Spring 2023 eDiscovery Business Confidence Survey Results. Law firms and software/services providers make up the majority of participants, with consultancies, corporations, media/research organizations, and others also playing significant roles. Respondents generally have an optimistic outlook on the current business conditions, with most considering them good. Over the next six months, a majority anticipate conditions to remain the same, while a smaller percentage foresee improvements.

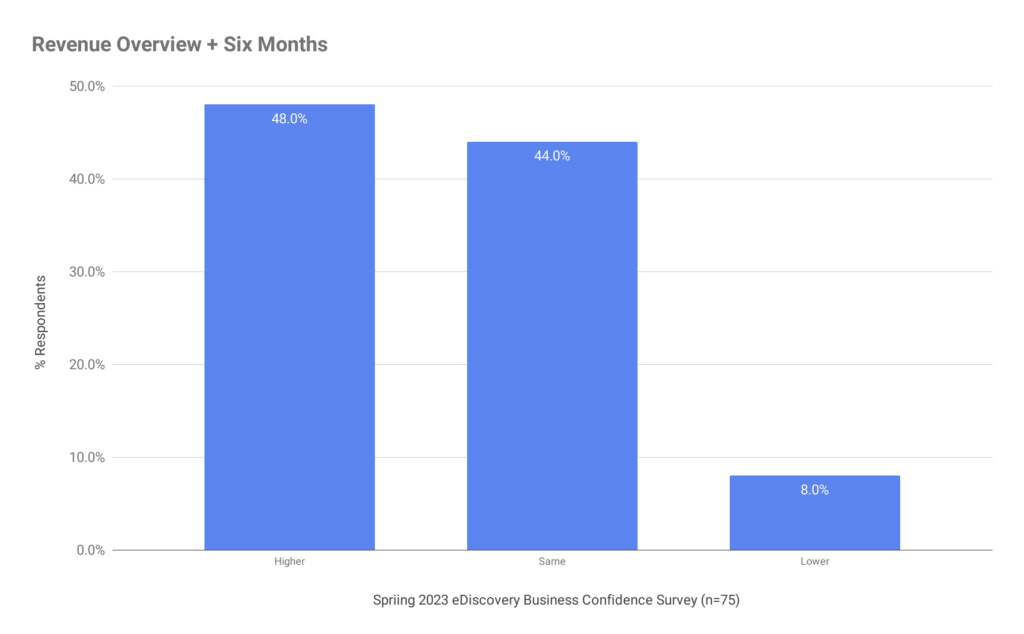

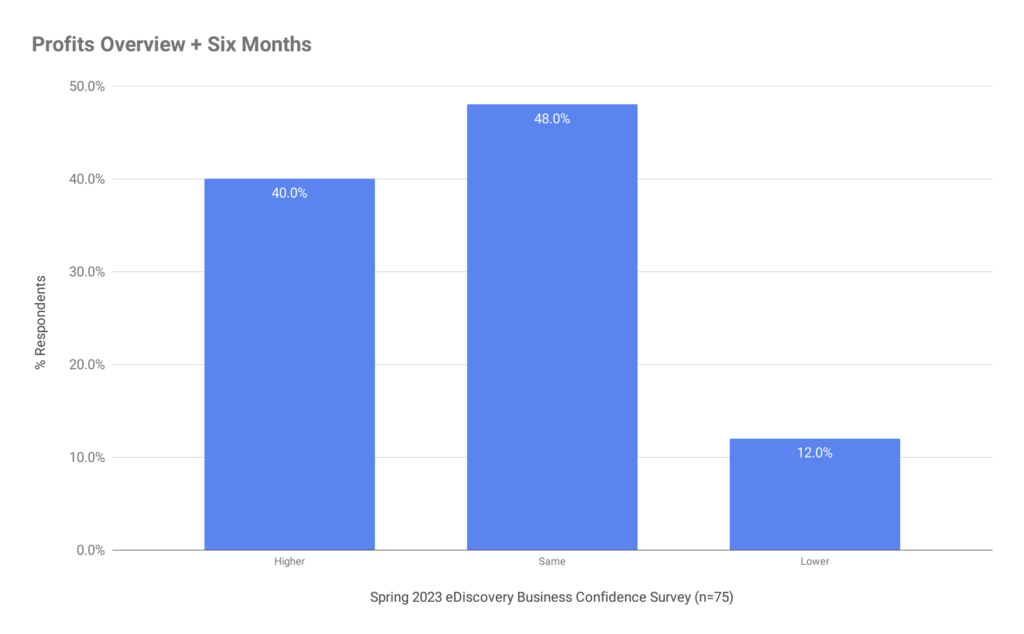

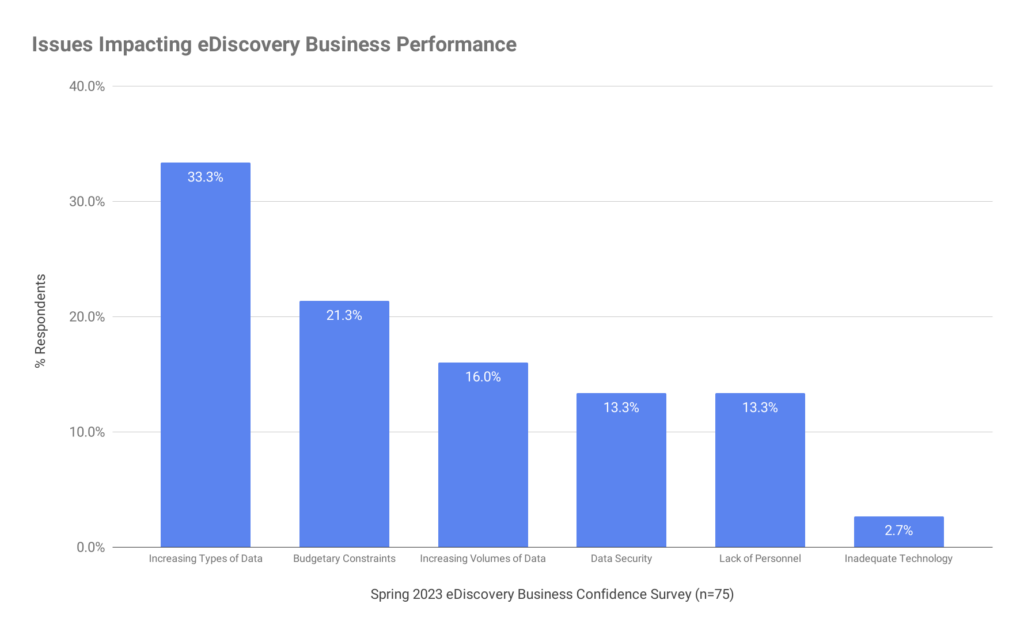

Revenue and profit expectations for the eDiscovery ecosystem are cautiously optimistic. Nearly half of the respondents expect higher revenues and a significant portion foresee stable revenues six months from now. Similarly, a considerable percentage of respondents predict higher profits, with others anticipating no change in profit levels. The industry faces various challenges, including increasing types of data, budgetary constraints, increasing data volumes, data security, and lack of personnel. However, inadequate technology appears to be less of a concern.

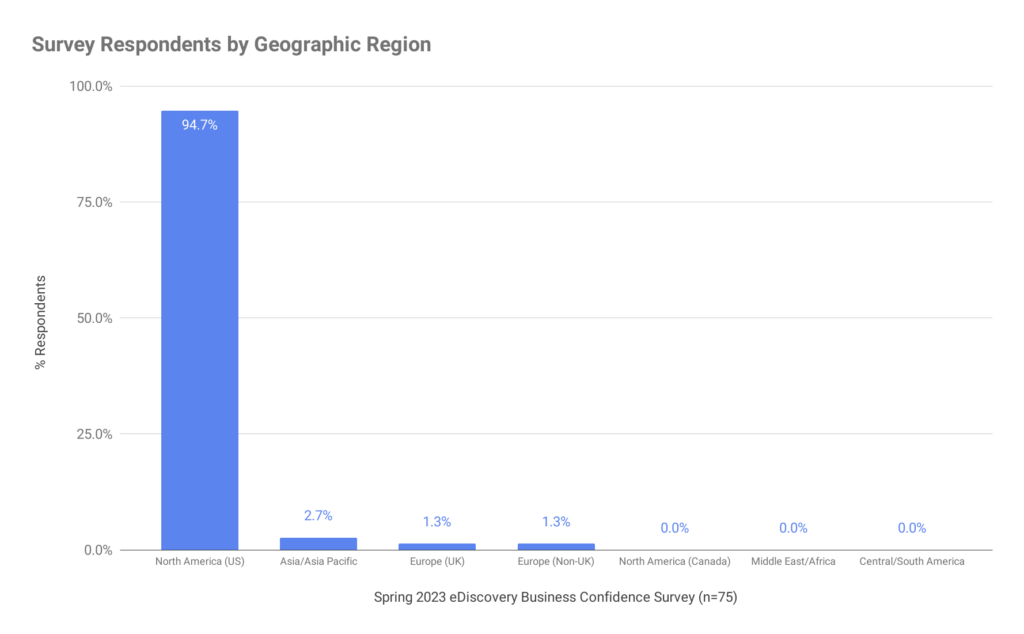

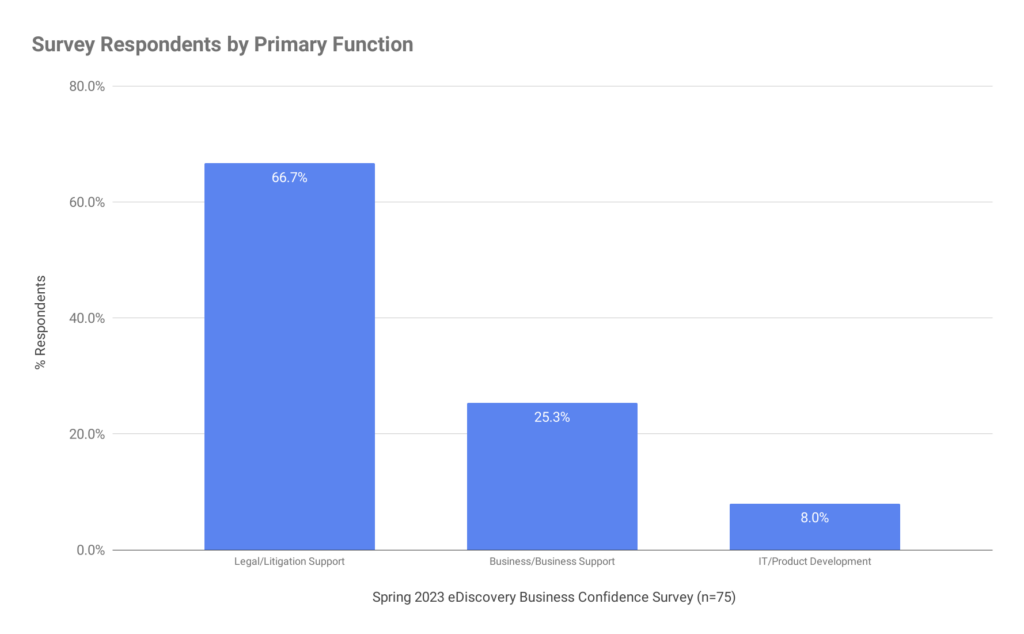

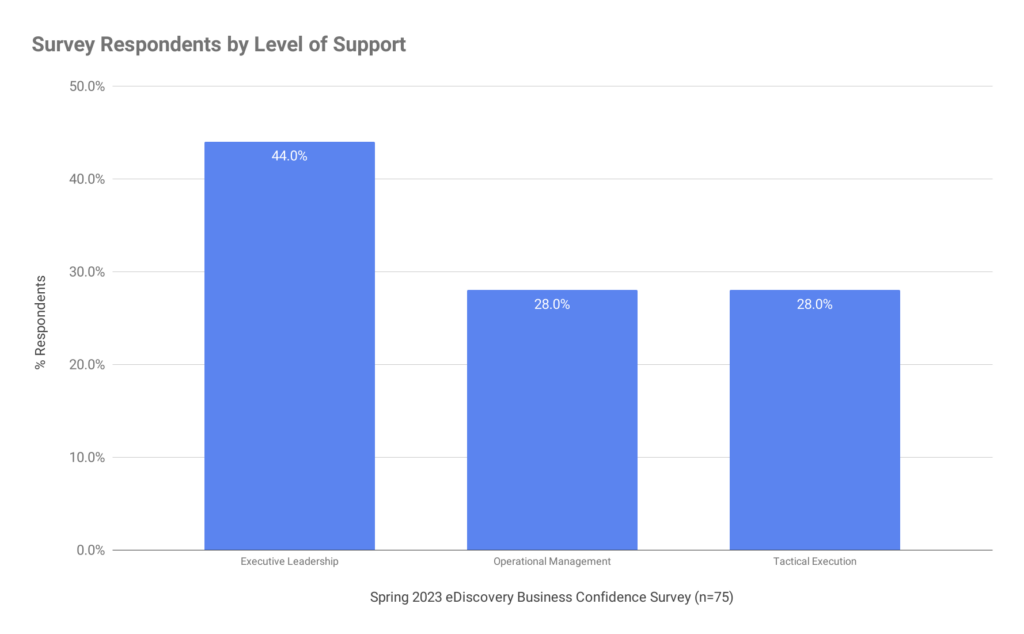

Most respondents primarily conduct their eDiscovery-related business in the United States, with a small portion operating in Asia/Asia Pacific and Europe. The majority focus on legal/litigation support, followed by business/business support and IT/product development. Executive leadership, operational management, and tactical execution roles are all well-represented among the respondents.

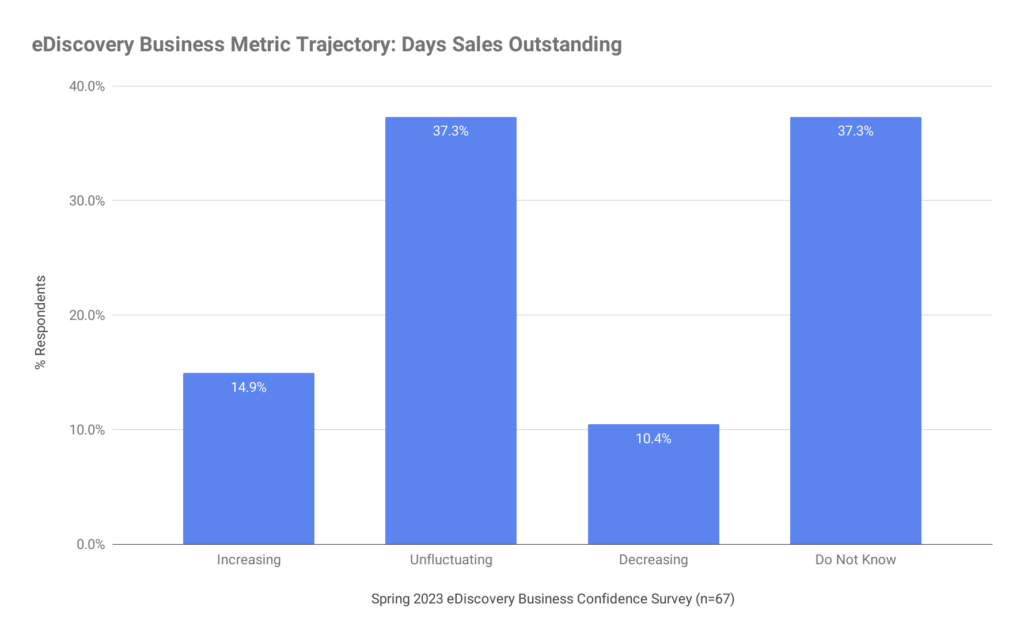

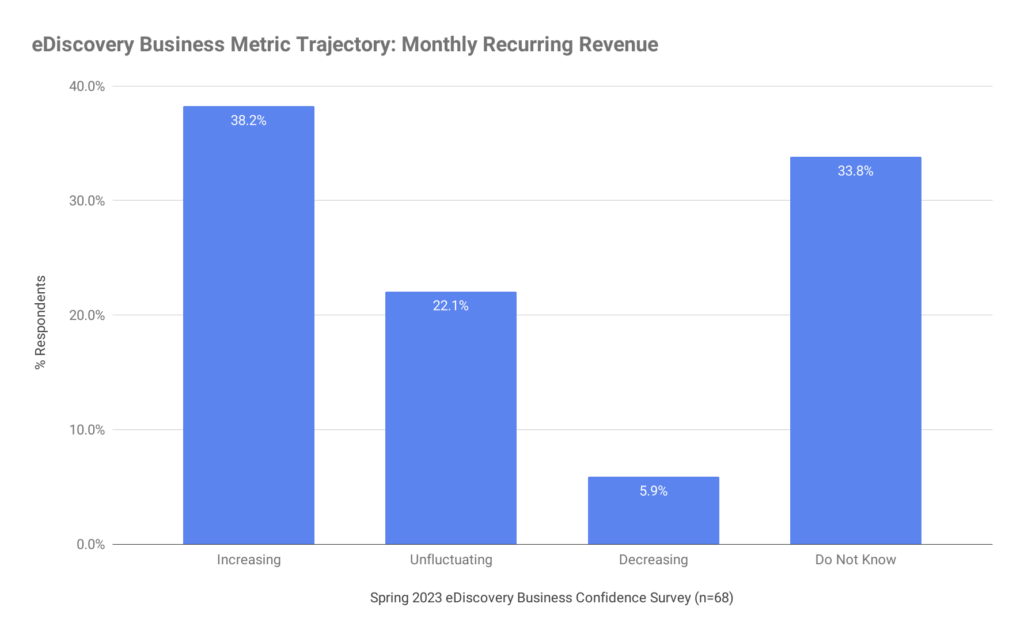

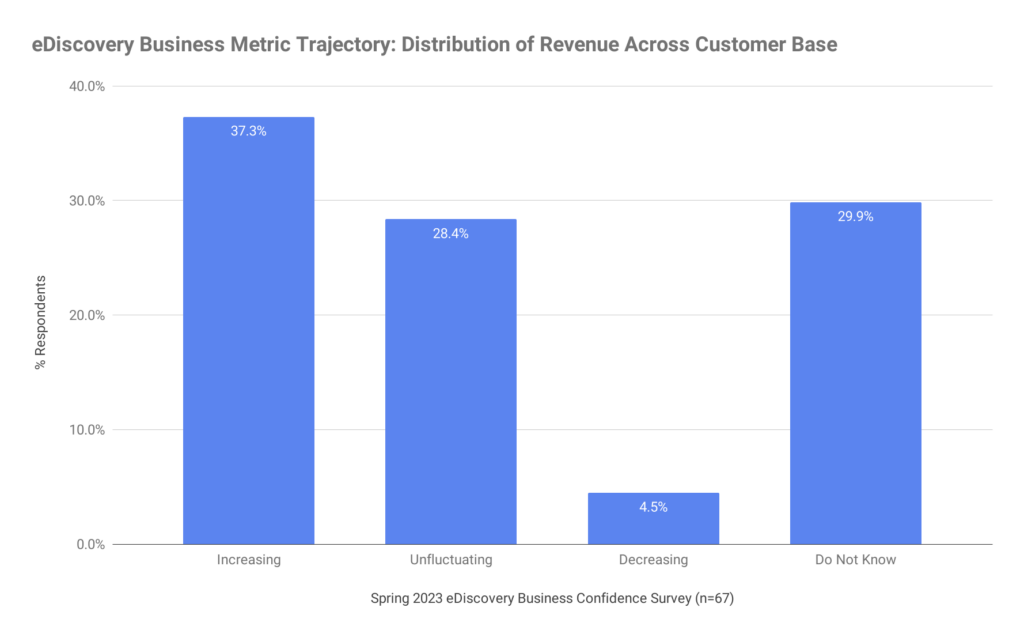

Organizations’ Days Sales Outstanding (DSO) and Monthly Recurring Revenue (MRR) trajectories are mixed. A significant portion report unfluctuating DSO, with some experiencing an increase and a smaller percentage seeing a decrease. MRR trends are mostly positive, with many respondents reporting an increase, while others note stable or decreasing trends. The distribution of organizations’ revenue across their customer base varies, with some experiencing increasing revenue distribution, others observing unchanging trends, and a smaller percentage facing a decrease. In general, the survey results paint a cautiously optimistic picture of the eDiscovery industry in Spring 2023.

Spring Survey Questions (Required)

n = 75 Respondents

1. Which of the following segments best describes your business in eDiscovery?

Part of the eDiscovery ecosystem where your organization resides

- Law Firm – 36.0% ↑

- Software or Services Provider – 33.3% ↑

- Consultancy – 10.7% ↓

- Corporation – 8.0% ↓

- Media/Research – 6.7% ↑

- Other – 5.3% ↓

- Governmental Entity – 0.0%

2. How would you rate the current general business conditions for eDiscovery in your segment?

Subjective feeling of business performance when compared with business expectations

- Good – 57.3.% ↑

- Normal – 36.0% ↓

- Bad – 6.7% ↑

3. How do you think the business conditions will be in your segment six months from now?

Subjective feeling of business performance when compared with business expectations

- Better – 34.7% ↑

- Same – 61.3% ↓

- Worse – 4.0% ↓

4. How would you guess revenue in your segment of the eDiscovery ecosystem will be six months from now?

Revenue is income generated from eDiscovery-related business activities

- Higher – 48.0% ↑

- Same – 44.0% ↓

- Lower – 8.0% ↓

5. How would you guess profits in your segment of the eDiscovery ecosystem will be six months from now?

Profit is the amount of income remaining after accounting for all expenses, debts, additional revenue streams, and operating costs

- Higher – 40.0% ↑

- Same – 48.0% ↓

- Lower – 12.0% ↑

6. Of the six items presented below, what is the issue that you feel will most impact the business of eDiscovery over the next six months?

Challenges that may directly impact the business performance of your organization

- Increasing Types of Data – 33.3% ↑

- Budgetary Constraints – 21.3% ↓

- Increasing Volumes of Data – 16.0% ↓

- Data Security – 13.3% ↓

- Lack of Personnel – 13.3% ↑

- Inadequate Technology – 2.7% ↓

7. In which geographical region do you primarily conduct eDiscovery-related business?

The location from which you are basing your business assessments

- North America (United States) – 94.7% ↑

- Asia/Asia Pacific – 2.7% ↑

- Europe (UK) – 1.3% ↓

- Europe (Non-UK) – 1.3% ↑

- North America (Canada) – 0.0% ↓

- Middle East/Africa – 0.0% =

- Central/South America – 0.0% =

8. What area best describes your primary function in the conduct of your organization’s eDiscovery-related business?

- Legal/Litigation Support – 66.7% ↓

- Business/Business Support (All Other Business Functions) – 25.3% ↑

- IT/Product Development – 8.0% ↑

9. What area best describes your level of support in the conduct of your organization’s eDiscovery-related business?

- Executive Leadership – 44.0% ↑

- Operational Management – 28.0% ↓

- Tactical Execution – 28.0% ↓

Business Metric Trajectory Questions (Optional)

10. How would you characterize the trajectory of your organization’s Days Sales Outstanding (DSO) during the last quarter?

n=67 Respondents

- Increasing – 14.9% ↓

- Unfluctuating – 37.3% ↑

- Decreasing – 10.4% ↑

- Do Not Know – 37.3% ↓

11. How would you characterize the trajectory of your organization’s Monthly Recurring Revenue (MRR) during the last quarter?

n=68 Respondents

- Increasing – 38.2% ↑

- Unfluctuating – 22.1% ↓

- Decreasing – 5.9% ↓

- Do Not Know – 33.8% ↓

12. Which of the following statements best describes the distribution of your organization’s revenue across your customer base during the last quarter?

n=67 Respondents

- Increasing – 37.3% ↑

- Unfluctuating – 28.4% ↓

- Decreasing – 4.5% ↓

- Do Not Know – 29.9% ↓

Trend Notes

- ↑ Increase from the last survey.

- ↓ Decrease from the last survey.

- = No change from the last survey.

*Survey methodology focuses on the achievement of at least 50 responses with the least number of emails sent to the ComplexDiscovery industry professional database. This approach seeks to minimize the number of requests for participation in surveys while ensuring a solid number of responses from which to generally assess market sentiment in survey areas of interest.

Source: ComplexDiscovery for the entire article augmented with historical data.