[EDRM’s Editor’s Note: This article was first published here on September 13, 2024, and EDRM is grateful to Rob Robinson, editor and managing director of Trusted Partner ComplexDiscovery, for permission to republish.]

ComplexDiscovery’s Editor’s Note: This article examines the rise in Hart-Scott-Rodino (HSR) Act transactions in August 2024, reaching 218 deals—the highest monthly total in fiscal year 2024. The surge reflects strong M&A activity and increased legal scrutiny, highlighting critical implications for eDiscovery professionals. As transaction volumes grow, so do the demands for compliance, regulatory reviews, and data management. The article offers key insights into how economic trends, including GDP growth and corporate profitability, are shaping the eDiscovery landscape, helping legal teams navigate this complex environment efficiently.

Background Note: The Hart Scott Rodino Act (HSR Act), a pivotal federal law, mandates companies to notify the Federal Trade Commission (FTC) and the Department of Justice (DOJ) before finalizing mergers or acquisitions involving certain assets or voting securities. This notification is part of the FTC and DOJ Premerger Notification Program, designed to enable a thorough review of proposed transactions for potential antitrust issues. For professionals in cybersecurity, information governance, and legal discovery operating within the eDiscovery ecosystem, tracking the monthly HSR transaction data, now enriched in this update with key economic indicators like GDP growth and corporate profits, offers critical insights. This enhanced perspective helps in understanding the broader economic implications of merger and acquisition activities and their potential impact on the eDiscovery landscape.

HSR Transactions Reach 218 in August 2024: What It Means for eDiscovery

In the mergers and acquisitions (M&A) landscape, the Hart-Scott-Rodino (HSR) Act transactions and economic trends such as GDP growth and personal income dynamics are important for eDiscovery professionals. This analysis integrates the latest HSR transaction data with key economic indicators, offering insights into how these factors impact the eDiscovery sector. By understanding the interplay between M&A activities and broader economic trends, legal professionals can better manage risks, optimize budgets, and leverage opportunities for their clients and organizations.

HSR Transactions and Economic Implications for eDiscovery

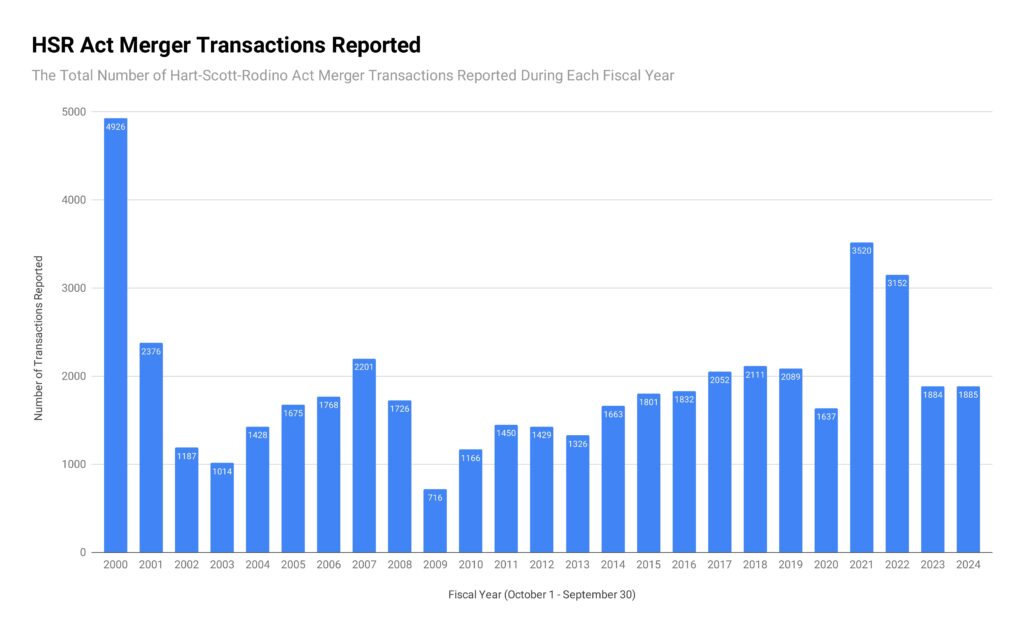

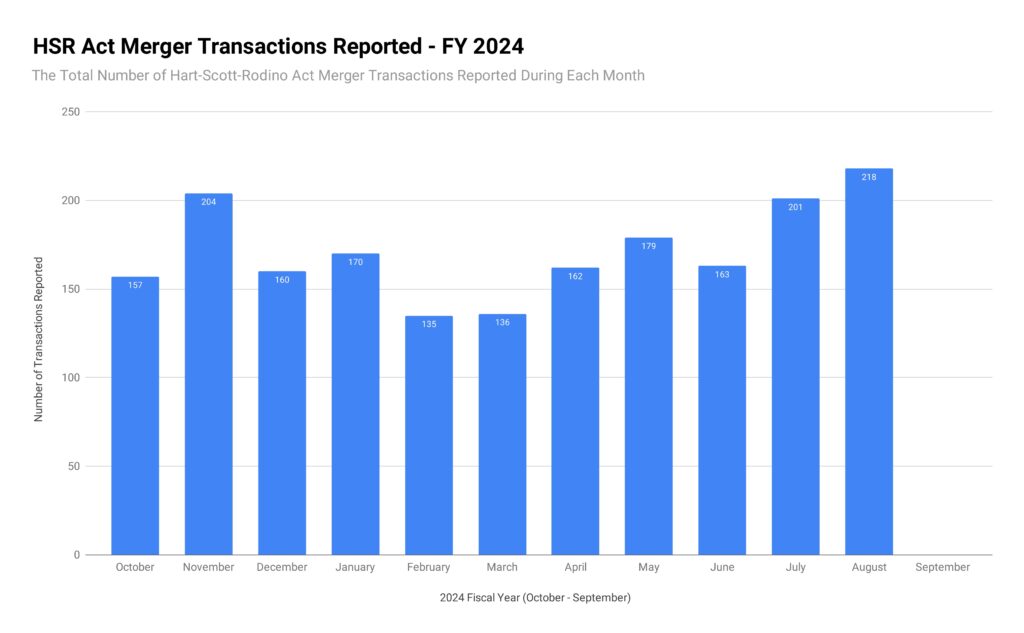

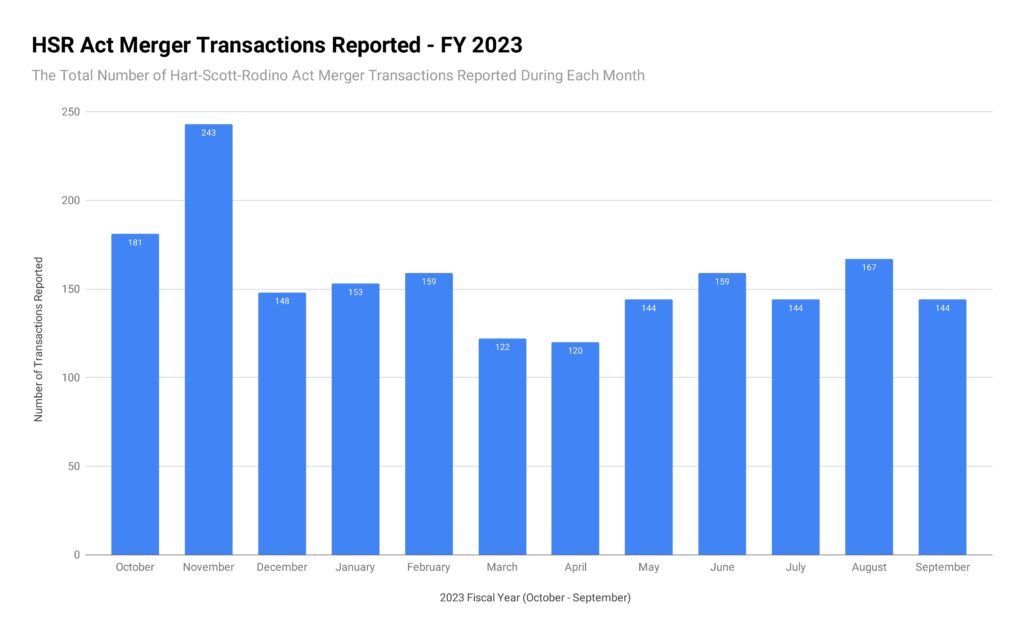

The most recent data from the Premerger Notification Office highlights an upward trend in HSR transactions, which saw 218 transactions in August 2024, increasing from 201 in July and 163 in June. This number marks the highest monthly total in fiscal year 2024 and reflects a robust M&A environment. With one month remaining in fiscal year 2024, the cumulative total of 1,885 transactions has already surpassed the 1,884 transactions recorded for fiscal year 2023.

This growth in M&A activity points to an increasing demand for legal services, particularly in compliance, regulatory reviews, and eDiscovery.

Rob Robinson, Editor and Managing Director of ComplexDiscovery.

This growth in M&A activity points to an increasing demand for legal services, particularly in compliance, regulatory reviews, and eDiscovery. As transaction volumes rise, so does the complexity of deal-making, requiring more sophisticated document management and regulatory solutions to meet the demands of legal scrutiny. For eDiscovery professionals, this means a heightened focus on efficient processes, advanced technology solutions, and readiness to support larger data volumes in time-sensitive M&A cases.

Broader Economic Trends and M&A Growth

On August 29, 2024, the U.S. Bureau of Economic Analysis (BEA) reported a robust second quarter for the U.S. economy, with real gross domestic product (GDP) growing at an annual rate of 3.0%, up from 1.4% in the first quarter. This acceleration was driven by increased consumer spending, higher private inventory investment, and a notable rise in nonresidential fixed investment, reflecting renewed business confidence.

Additionally, corporate profits experienced a strong recovery, rebounding by $57.6 billion in the second quarter after a steep $47.1 billion decline in the first. This resurgence of profitability provides businesses with the capital to pursue more aggressive growth strategies, including M&A transactions, amplifying the demand for eDiscovery services. Companies navigating this landscape require robust eDiscovery solutions to ensure compliance with regulatory frameworks, manage large volumes of transactional data, and mitigate potential legal risks.

As corporate profits rise and M&A activities increase, so does legal scrutiny, particularly in sectors facing antitrust and regulatory oversight. eDiscovery professionals must be prepared to address these challenges by providing tailored solutions that streamline data management processes and support regulatory investigations.

The Impact of Personal Income and Inflation on Legal Budgets

The BEA’s July 2024 Personal Income and Outlays report, released on August 30, 2024, showed a continued increase in personal income (up 0.3%) and disposable personal income (also up 0.3%). Personal consumption expenditures rose by 0.5%, indicating that consumer confidence remains strong despite inflationary pressures. However, inflation, as measured by the PCE price index, increased by 2.5% year-over-year, suggesting rising costs across the economy.

For legal and eDiscovery professionals, the relationship between rising personal income, consumer spending, and inflation has direct implications for corporate legal budgets. As companies experience higher revenues due to increased consumer spending, they may allocate more resources toward legal services, including eDiscovery, to support M&A activity and compliance efforts. However, inflationary pressures may also compel companies to reassess their spending priorities. Legal departments may prioritize essential services like compliance, litigation support, and regulatory management while cutting back on discretionary eDiscovery expenditures.

To navigate this environment, eDiscovery professionals must offer cost-effective, scalable solutions that align with the financial constraints of their clients. This could involve leveraging AI-driven technologies, automating workflows, and employing advanced analytics to reduce costs while maintaining service quality and efficiency.

Industry-Specific eDiscovery Challenges

Different industries experience varying levels of eDiscovery demand depending on economic shifts and sector-specific challenges. For instance, the retail sector may scale back legal spending in response to declining consumer confidence, limiting their ability to manage compliance and litigation efficiently. In contrast, industries like healthcare and financial services often face heightened regulatory scrutiny, driving an increased demand for eDiscovery solutions to support compliance and risk management.

Sectors experiencing significant M&A activity or regulatory change, such as technology, healthcare, and finance, are more likely to invest heavily in legal support services, including eDiscovery. Legal teams in these sectors will continue to seek advanced, AI-driven solutions to manage large volumes of data and ensure compliance with evolving regulations.

Outlook for eDiscovery Professionals

The outlook for eDiscovery professionals remains positive, with M&A activity continuing at a steady pace, driven by strong economic growth and corporate profitability. While inflationary pressures and budget constraints may influence legal spending decisions, the demand for efficient, cost-effective eDiscovery solutions is expected to remain strong, particularly in industries experiencing regulatory scrutiny and increased M&A activity.

To remain competitive, eDiscovery providers should focus on integrating technological advancements, such as AI and advanced analytics, into their offerings to enhance efficiency and reduce operational costs.

Rob Robinson, Editor and Managing Director of ComplexDiscovery.

To remain competitive, eDiscovery providers should focus on integrating technological advancements, such as AI and advanced analytics, into their offerings to enhance efficiency and reduce operational costs. Staying informed about regulatory developments in areas like antitrust, data privacy, and cross-border data transfers will also be critical for navigating the changing legal landscape.

By proactively adapting to economic trends and addressing regulatory challenges, eDiscovery professionals can help their clients remain compliant, efficient, and aligned with broader business objectives.

Transaction Charts

Taken from the latest published Hart-Scott-Rodino (HSR) Premerger Notification monthly transactions as shared by the Federal Trade Commission (FTC) and augmented by released annual reports, the following transaction charts may be useful for law firms, legal departments, and legal service providers seeking to understand the real-time pulse rate of Hart-Scott-Rodino Act mandated transaction reviews. As these reviews may lead to Second Requests, the charts may also be useful as a baseline for considering provider assertions regarding the depth, breadth, and volume of their Second Request support for this unique type of eDiscovery during specific time frames.

*Monthly Real-Time Reporting – First Report is October 2019 (Monthly Running Report)

**Based on Annual Reporting as Represented in Final Annual HSR Transaction Reports.

Read the original release here.

About ComplexDiscovery

ComplexDiscovery is a highly recognized digital publication focused on providing detailed insights into the fields of cybersecurity, information governance, and eDiscovery. Learn more today at ComplexDiscovery.com.

News Sources

- Premerger Notification Program | Federal Trade Commission (ftc.gov)

- Gross Domestic Product (Second Estimate), Corporate Profits (Preliminary Estimate), Second Quarter 2024 | U.S. Bureau of Economic Analysis (BEA)

- Personal Income and Outlays, July 2024 | U.S. Bureau of Economic Analysis (BEA)

- July 2024 HSR Transactions: What GDP Growth and Economic Trends Mean for eDiscovery (complexdiscovery.com)

Additional Reading

- HSR Act Reporting: A ComplexDiscovery Chronology

- FTC Annual Competition Reports (Hart-Scott-Rodino Act Reports)

Source: ComplexDiscovery OÜ

Assisted by GAI and LLM Technologies per EDRM GAI and LLM Policy.