[EDRM’s Editor’s Note: This article was first published here on November 6, 2024, and EDRM is grateful to Rob Robinson, editor and managing director of Trusted Partner ComplexDiscovery, for permission to republish.]

ComplexDiscovery’s Editor’s Note: This concise analysis delves into the historical trends of Second Requests in U.S. antitrust review, spanning from 2000 to 2023. It explores how these trends correlate with presidential administrations, underscoring the impact of political shifts on regulatory scrutiny. The article further examines potential implications for cybersecurity, information governance, and eDiscovery professionals following the re-election of President Donald Trump in 2024, outlining how his administration’s regulatory philosophy could influence these sectors. This piece provides business and legal professionals with essential insights into preparing for strategic adjustments in light of anticipated policy changes.

Analyzing Second Requests: Trends in Premerger Antitrust Review and Political Influence

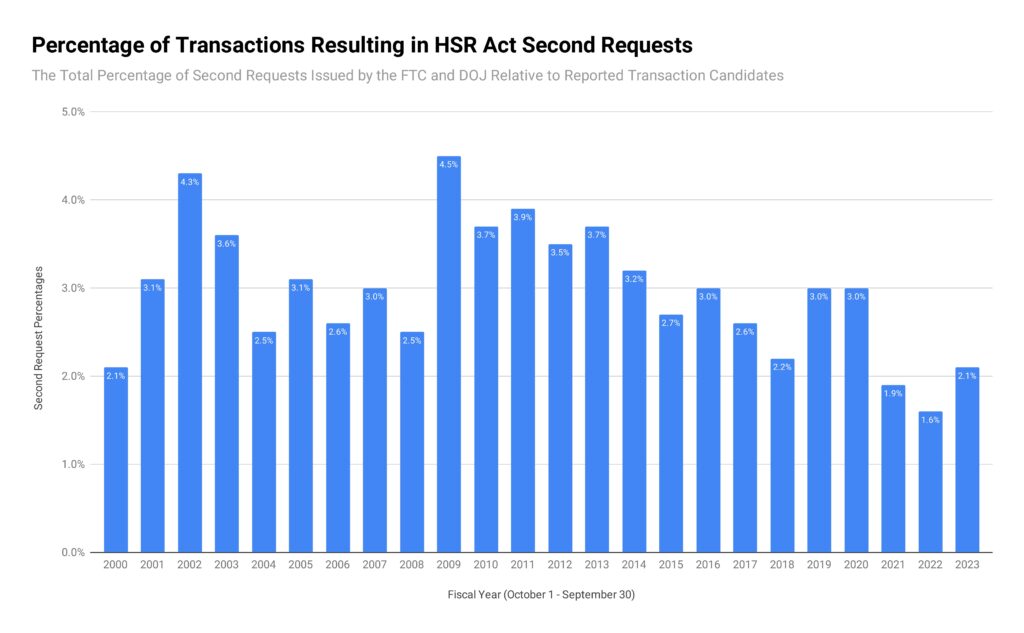

Understanding the trends in Second Requests under the Premerger Notification Program is vital for business and legal professionals involved in mergers and acquisitions. These requests, a mechanism for antitrust review by the U.S. government, indicate the level of regulatory scrutiny applied to transactions that may affect competition. A comprehensive review of data spanning 2000 to 2023 reveals not only the cyclical nature of Second Requests but also their correlation with the presidential administrations in office, highlighting how political climates influence antitrust enforcement.

Antitrust Trends from 2000 to 2023

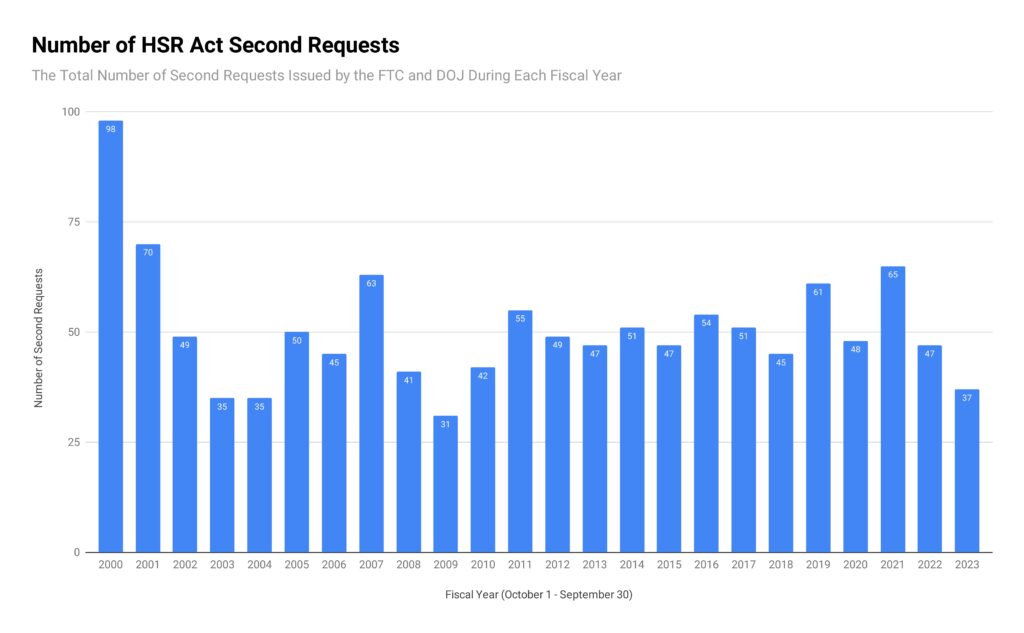

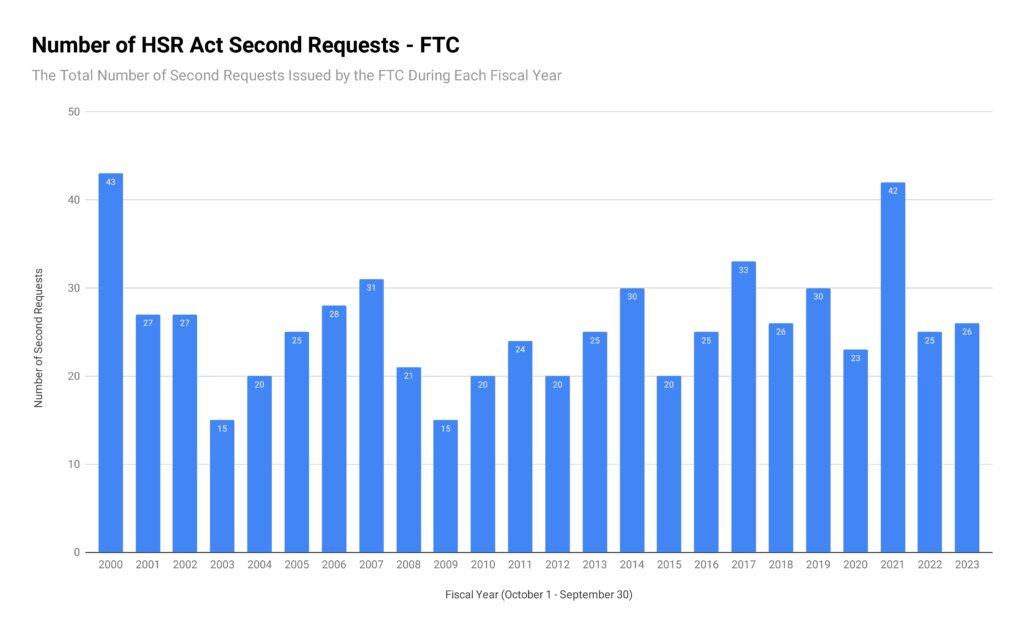

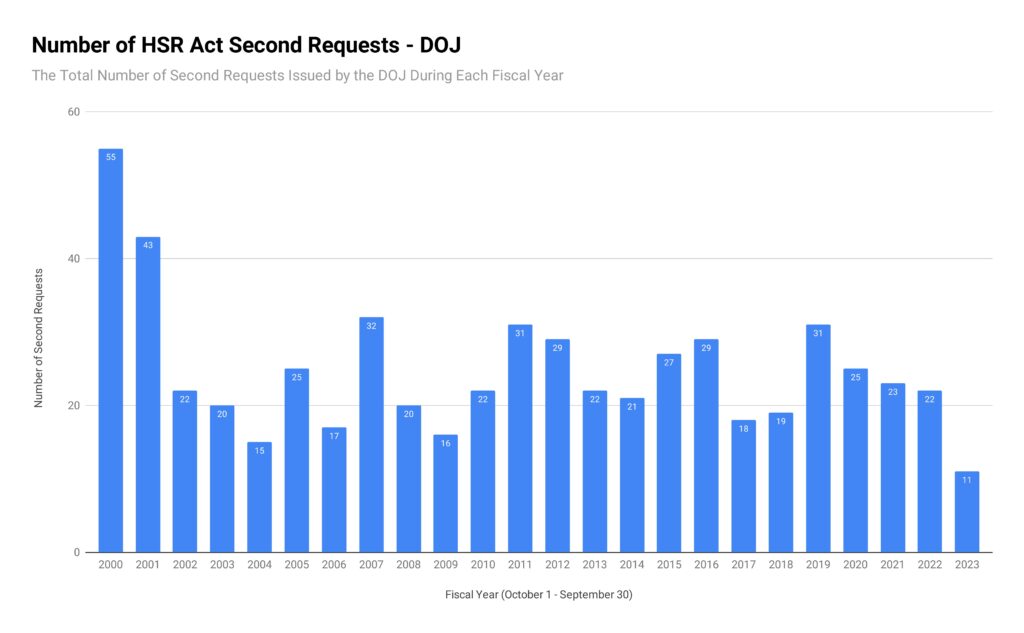

The frequency of Second Requests over the past two decades has fluctuated significantly, reflecting changes in regulatory approaches and economic conditions. The data show that the early 2000s were marked by higher scrutiny, with 98 Second Requests reported in 2000. This period, coinciding with the end of the Clinton administration, set a high benchmark for regulatory review.

A comprehensive review of data spanning 2000 to 2023 reveals not only the cyclical nature of Second Requests but also their correlation with the presidential administrations in office, highlighting how political climates influence antitrust enforcement.

Rob Robinson, Editor and Managing Director of ComplexDiscovery.

As President George W. Bush took office in 2001, the number of Second Requests began to decline. By the end of his presidency in 2008, the number of requests had dropped to 41. This decrease aligns with a conservative economic philosophy that generally favored deregulation and a less aggressive approach to antitrust enforcement. Business professionals navigating mergers during this time benefited from a regulatory environment that was comparatively lenient, though still attentive to significant antitrust concerns.

Shifts Under Obama

The trend shifted markedly when President Barack Obama assumed office in 2009. The economic context of the time, following the 2008 financial crisis, had an impact on both regulatory focus and overall transaction volume. Initial counts in 2009 were at a low of 31 Second Requests, but this number rose steadily, peaking at 55 in 2011. The Obama administration’s regulatory philosophy was more proactive, emphasizing the protection of competition and consumer interests. By 2016, the administration maintained consistent oversight, with 54 Second Requests in its final year. This period underscored the administration’s commitment to a balanced but firm antitrust policy.

Moderation Under Trump

The transition to President Donald Trump’s administration brought with it a shift back toward a pro-business regulatory stance. From 2017 to 2020, the number of Second Requests stabilized, with annual counts ranging between 45 and 61. The peak of this era was in 2019 with 61 requests, suggesting that while the administration was more business-friendly, it did not wholly eschew regulatory responsibilities. This balance reflected a nuanced approach that maintained oversight without imposing excessive barriers to corporate transactions.

Biden’s Early Antitrust Focus

President Joe Biden’s tenure has, thus far, been marked by an explicit focus on antitrust issues, signifying a continuation of proactive policies similar to those of the Obama administration. In 2021, the number of Second Requests reached 65, highlighting an initial strong commitment to rigorous antitrust scrutiny. However, this intensity appeared to wane as recent data from 2022 and 2023 showed a decline to 47 and 37 Second Requests, respectively. This decline may be attributed to economic factors such as the post-COVID-19 recovery and potential shifts in regulatory strategy aimed at balancing competition enforcement with economic growth.

Economic Influences on Enforcement

The broader economic context has played a crucial role in the frequency of Second Requests. The significant drop to 31 Second Requests in 2009 corresponds with the economic downturn following the financial crisis. Similarly, lower counts in recent years may reflect caution in a post-pandemic economic landscape, with regulators possibly moderating their approach to foster stability and growth.

Political Correlation and Business Implications

The data indicate that Democratic administrations typically align with higher rates of Second Requests, indicative of a more stringent approach to merger reviews. Presidents Obama and Biden have each emphasized consumer welfare and competitive markets, resulting in increased scrutiny of corporate transactions. Conversely, Republican administrations, under Presidents Bush and Trump, have generally shown a preference for reduced regulation, allowing for more streamlined merger processes while maintaining essential antitrust oversight.

This analysis is relevant for business and legal professionals as it illustrates the interplay between political ideology and regulatory practice. Understanding these trends helps stakeholders better anticipate potential challenges in merger proceedings. Companies planning significant transactions can leverage this historical insight to prepare for varying degrees of regulatory review, adapting their strategies to the current and anticipated enforcement environment.

Intermediate Analysis

The landscape of antitrust enforcement, as reflected by Second Requests over the last two decades, showcases a dynamic interplay between political administration, economic context, and regulatory philosophy. While policy shifts are influenced by changes in leadership, the overarching commitment to maintaining fair competition remains a constant. For business leaders and legal professionals, keeping abreast of these trends is crucial to navigating mergers effectively and anticipating the degree of scrutiny they may face.

Implications for Cybersecurity, Information Governance, and eDiscovery Professionals Amid Trump’s Presidential Return

With the re-election of President Donald Trump in 2024, regulatory expectations in sectors such as cybersecurity, information governance, and eDiscovery may shift, reflecting his administration’s historically business-friendly stance. While the last Trump administration (2017-2020) showcased a balanced approach to antitrust scrutiny, it tended to favor policies that fostered growth and limited regulatory constraints. This backdrop presents both opportunities and challenges for professionals in these fields.

Cybersecurity Considerations

For cybersecurity professionals, a business-centric regulatory framework could mean a renewed emphasis on private-sector-led initiatives for protecting digital assets and maintaining data security. The previous Trump administration often advocated for collaborative, rather than mandatory, cybersecurity measures, placing greater trust in industry self-regulation. A potential return to these policies could encourage innovation but may reduce stringent oversight. Organizations may need to prepare for heightened responsibilities in ensuring their cybersecurity practices meet best practices, as government-driven mandates could become less prominent.

Information Governance and Data Management

In the area of information governance, a deregulatory environment could simplify certain compliance protocols, allowing organizations more flexibility in managing data assets. This flexibility, however, would come with the risk of inconsistent standards and practices across industries. Professionals in this field should consider reinforcing their internal governance frameworks to align with global standards and best practices, as U.S. federal oversight might not be as aggressive. The responsibility to ensure compliance with complex and evolving regulations may increasingly shift to organizations, necessitating a proactive approach to data policy formulation.

With the re-election of President Donald Trump in 2024, regulatory expectations in sectors such as cybersecurity, information governance, and eDiscovery may shift, reflecting his administration’s historically business-friendly stance.

Rob Robinson, Editor and Managing Director of ComplexDiscovery.

eDiscovery Dynamics

eDiscovery professionals could see a varied impact depending on how the new administration prioritizes regulation. During President Trump’s earlier term, regulatory scrutiny was moderated, impacting how mergers, investigations, and large-scale litigations were managed. If this pattern resumes, professionals in eDiscovery may anticipate fewer regulatory-driven demands for data collection and processing during merger reviews, potentially altering the volume and nature of discovery efforts. However, as businesses take advantage of a looser regulatory climate to explore larger, potentially riskier mergers, the complexity of eDiscovery cases could rise, emphasizing the need for adaptive technology and robust processes to handle large-scale data reviews efficiently.

Strategic Preparation for Professionals

Cybersecurity, information governance, and eDiscovery professionals should approach this new phase of administration with a strategic mindset, recognizing the potential for regulatory shifts and preparing for adaptive policy responses. Building partnerships with external compliance advisors and bolstering internal teams with cross-disciplinary expertise will be vital to navigating this landscape effectively.

Organizations may also benefit from continuous scenario planning, assessing potential changes in regulatory expectations under a business-friendly administration. This proactive stance can position firms to respond swiftly to both opportunities and challenges posed by reduced oversight, allowing them to maintain resilience, secure data handling, and readiness for any regulatory changes that could arise unexpectedly.

Closing Analysis

President Trump’s 2024 election signals a return to policies that could ease regulatory scrutiny on corporate activity, affecting sectors such as cybersecurity, information governance, and eDiscovery. While this environment may present opportunities for growth and operational efficiency, it also places the onus on professionals and organizations to sustain rigorous, self-imposed standards of security and compliance. Maintaining vigilance, aligning with best practices, and preparing for evolving business landscapes will be essential for navigating the potential impacts of this new administration on professional practice.

Read the original article here.

About ComplexDiscovery OÜ

ComplexDiscovery OÜ is a highly recognized digital publication providing insights into cybersecurity, information governance, and eDiscovery. Based in Estonia, ComplexDiscovery OÜ delivers nuanced analyses of global trends, technology advancements, and the legal technology sector, connecting intricate issues with the broader narrative of international business and current events. Learn more at ComplexDiscovery.com.

News Sources

- Annual Competition Reports | Federal Trade Commission

- FTC and DOJ Report on Merger Trends in 2023: A Year of Big Deals and Big Scrutiny

- U.S. Presidents, Presidential Terms, Election Results, Timelines | Britannica

Additional Reading

- HSR Act Reporting: A ComplexDiscovery Chronology

- EU Antitrust Chief Margrethe Vestager’s Legacy of Big Tech Accountability

Source: ComplexDiscovery OÜ

Assisted by GAI and LLM Technologies per EDRM GAI and LLM Policy.