[EDRM Editor’s Note: This article was first published here on August 18, 2025, and EDRM is grateful to Rob Robinson, editor and managing director of Trusted Partner ComplexDiscovery, for permission to republish.]

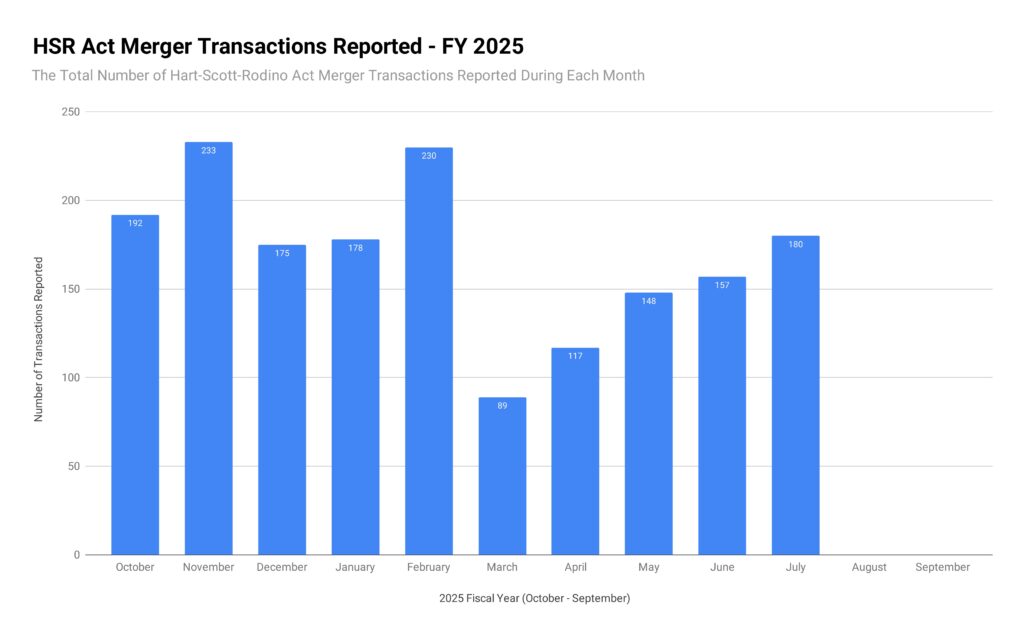

ComplexDiscovery Editor’s Note: The July 2025 HSR data reflects a market defined by resilient dealmaking and deliberate pacing. With 180 filings in July and 1,699 year-to-date, activity is tracking just below recent averages but shows clear momentum as economic conditions improve. For cybersecurity, information governance, and eDiscovery professionals, the implications are clear: as filings rise, so do regulatory expectations and operational risks. Secure, compliant, and well-governed deal execution is no longer optional—it is the foundation of strategic success in today’s M&A environment.

Background Note: The Hart-Scott-Rodino (HSR) Act established the Premerger Notification Program, requiring certain mergers and acquisitions to be reported to the Federal Trade Commission (FTC) and the Department of Justice (DOJ) for antitrust review. This program ensures that transactions meeting specific thresholds are evaluated for their potential impact on competition before they are finalized. The HSR filing process plays a critical role in preserving competitive markets by identifying and addressing potential risks, such as monopolistic practices or reduced consumer choice.

Under the program, companies must submit detailed documentation about the transaction and the parties involved. A waiting period—typically 30 days—follows, allowing regulators to review the deal and determine whether further investigation is needed. This process can impact transaction timelines and requires robust compliance and information governance frameworks to manage the regulatory requirements.

Through July 2025, corporate M&A activity in the United States continues to reflect disciplined execution amid evolving economic signals. Hart-Scott-Rodino (HSR) premerger notification filings reached 1,699 transactions for the fiscal year to date (October 2024 through July 2025), with 180 filings in July—marking a modest but encouraging rise from the 157 filed in June. This steady pace underscores a market in recalibration, not retreat, where dealmakers remain focused on strategic priorities while navigating economic uncertainty and regulatory complexity.

Strategic Timing Amid Monthly Variability

The month-to-month trajectory of HSR filings in Fiscal Year 2025 reveals a rhythm shaped by both economic cycles and strategic intent. November 2024 (233 filings) and February 2025 (230 filings) represented the year’s high points, while March marked the low with just 89 transactions. The steady increase since April, culminating in July’s 180 filings, shows that firms are tactically advancing deals in alignment with improved macroeconomic indicators—particularly as inflation moderates and GDP growth rebounds.

The steady increase since April, culminating in July’s 180 filings, shows that firms are tactically advancing deals in alignment with improved macroeconomic indicators—particularly as inflation moderates and GDP growth rebounds.

Rob Robinson, Editor and Managing Director, ComplexDiscovery.

The average monthly volume now sits at 169.9 transactions, nearly on par with the previous fiscal year’s average, confirming that U.S. dealmaking remains active and resilient, albeit more measured. This pattern echoes post-crisis behavior seen in previous economic cycles, where transaction volume stabilizes before accelerating again—typically with heightened emphasis on diligence, value creation, and compliance readiness.

Macroeconomic Backdrop: Growth Rebounds, Inflation Eases

The broader economic landscape adds important context to the evolving deal environment. After a contraction in Q1, real GDP rebounded in Q2 2025 with a 3.0% annualized gain, driven by strong consumer spending and a decline in imports. Disposable personal income increased 0.3% in June, while the personal saving rate remained at 4.5%, indicating cautious but steady household financial behavior.

At the same time, inflation is cooling. The personal consumption expenditures (PCE) price index rose 0.3% month-over-month and 2.6% year-over-year in June, while the core PCE index—excluding food and energy—rose 2.8% from the prior year. These figures suggest that inflationary pressures, while still present, are diminishing—an encouraging signal for boardrooms considering strategic moves.

The U.S. trade deficit also narrowed in June to $60.2 billion, down from $71.7 billion in May. This reduction, led by declining imports of consumer goods and industrial supplies, reinforces the GDP improvement and reflects shifting global demand and trade patterns.

This reduction, led by declining imports of consumer goods and industrial supplies, reinforces the GDP improvement and reflects shifting global demand and trade patterns.

Rob Robinson, Editor and Managing Director, ComplexDiscovery.

Cybersecurity, Governance, and eDiscovery: High Stakes in High Velocity Environments

With deal volumes rising again and regulatory scrutiny ever-present, professionals in cybersecurity, information governance, and eDiscovery are central to ensuring secure, compliant, and successful transaction execution.

Cybersecurity: The Front Line of Deal Risk

As companies integrate systems, data, and infrastructure post-merger, cybersecurity risks spike. Sophisticated threat actors view transactional activity as an opportunity to exploit weaknesses. Cyber teams must engage early in the deal lifecycle, performing pre-acquisition risk assessments, securing deal data, and monitoring for threats throughout the integration process.

Key tactics include zero-trust architectures, encrypted collaboration environments, and endpoint threat detection tuned to transitional risk factors.

Information Governance: Unifying Frameworks Across Entities

M&A transactions introduce enormous governance challenges—particularly when merging organizations with disparate records policies and regulatory obligations. Multinational deals only heighten the complexity. Governance professionals must quickly harmonize data taxonomies, establish defensible retention schedules, and align internal compliance systems to avoid exposure during audits or future litigation.

Strong information governance not only reduces risk but also enhances operational efficiency across the newly formed entity.

eDiscovery: Readiness as a Competitive Advantage

eDiscovery is no longer a reactive process—it’s a strategic capability. As the Federal Trade Commission and Department of Justice continue to issue second requests and challenge deals more aggressively, legal teams must be prepared to respond effectively. Those with agile eDiscovery infrastructures—leveraging cloud-native tools, analytics, and proactive data mapping—can dramatically reduce response times and avoid costly delays.

Being audit-ready is now a prerequisite for deal approval.

Outlook: Precision Over Pace

The July 2025 data reinforces a prevailing theme in today’s M&A climate: precision matters more than pace. Filings are rising, but not in a frothy or erratic fashion. Instead, transactions are being executed with methodical intent—supported by rigorous due diligence, operational preparedness, and cross-functional alignment.

Cybersecurity, governance, and legal discovery are no longer back-office functions. They are strategic enablers, embedded in the earliest phases of deal evaluation and execution. Organizations that prioritize these domains are more likely to close deals efficiently, satisfy regulatory requirements, and realize post-merger value.

Looking Forward

As Fiscal Year 2025 enters its final quarter, all signs indicate a cautious yet optimistic continuation of M&A activity. With inflation easing and GDP growing, dealmakers have reason to lean in—but only with robust, secure, and well-governed processes in place.

For professionals tasked with safeguarding data, ensuring compliance, and managing discovery, the mission is clear: stay proactive, stay aligned, and stay indispensable.

For professionals tasked with safeguarding data, ensuring compliance, and managing discovery, the mission is clear: stay proactive, stay aligned, and stay indispensable.

Rob Robinson, Editor and Managing Director, ComplexDiscovery.

Analysis based on Hart-Scott-Rodino filing data through July 2025, U.S. Bureau of Economic Analysis reports, and industry observations. For the most current HSR statistics and regulatory updates, consult Federal Trade Commission publications and qualified legal counsel.

HSR Transaction Activity by the Numbers

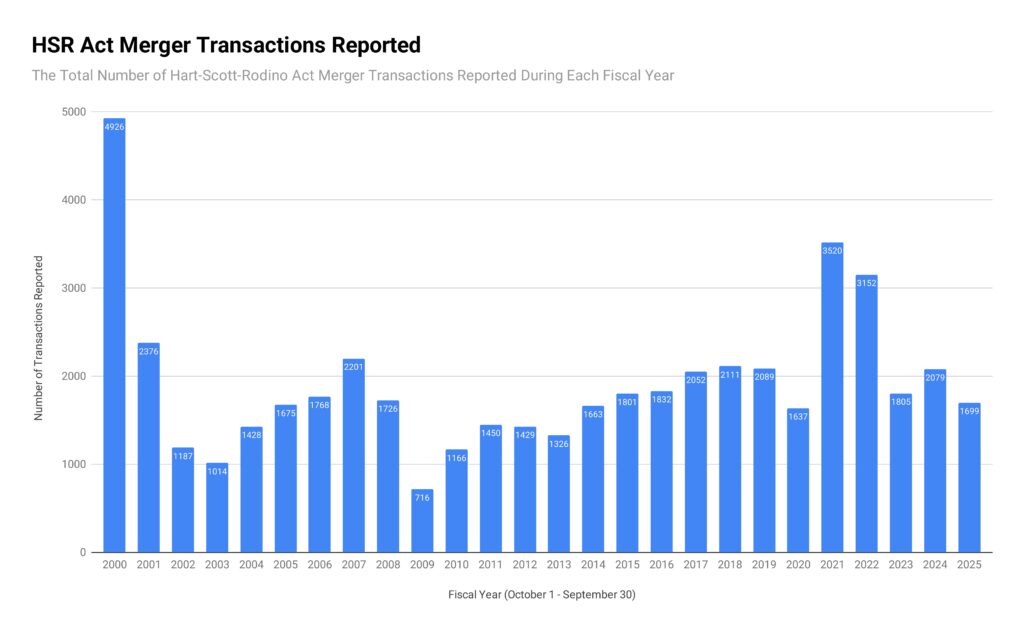

HSR Transactions by Fiscal Year: 2000–2025

This chart illustrates annual Hart-Scott-Rodino (HSR) premerger notification transactions reported from fiscal year 2000 through 2025. Over the past 25 years, filings have shown pronounced cyclical swings, peaking at 4,926 transactions in 2000 during the dot-com boom and falling to a low of 716 in 2009 amid the global financial crisis. More recently, activity has stabilized into a recalibrated but resilient range, averaging roughly 2,370 transactions annually from 2020 through 2025. With 1,699 filings reported through July 2025, the current fiscal year is tracking slightly below that recent average, but consistent with a pattern of deliberate, strategically timed transactions. This long-term perspective underscores the cyclical nature of merger activity and the market’s capacity for adaptation.

HSR Transactions by Month: October 2024 – July 2025

This chart presents the monthly HSR transaction counts for fiscal year 2025 through July 2025. The data highlights variability in activity, with a peak of 233 filings in November 2024 and a low of 89 in March 2025. Since spring, filings have risen steadily, from 117 in April to 180 in July, surpassing the fiscal year’s monthly average of ~170 transactions. The rebound indicates renewed momentum as economic conditions improve. These fluctuations reflect both market dynamics and strategic timing, reinforcing the notion that dealmaking remains measured yet resilient in FY25.

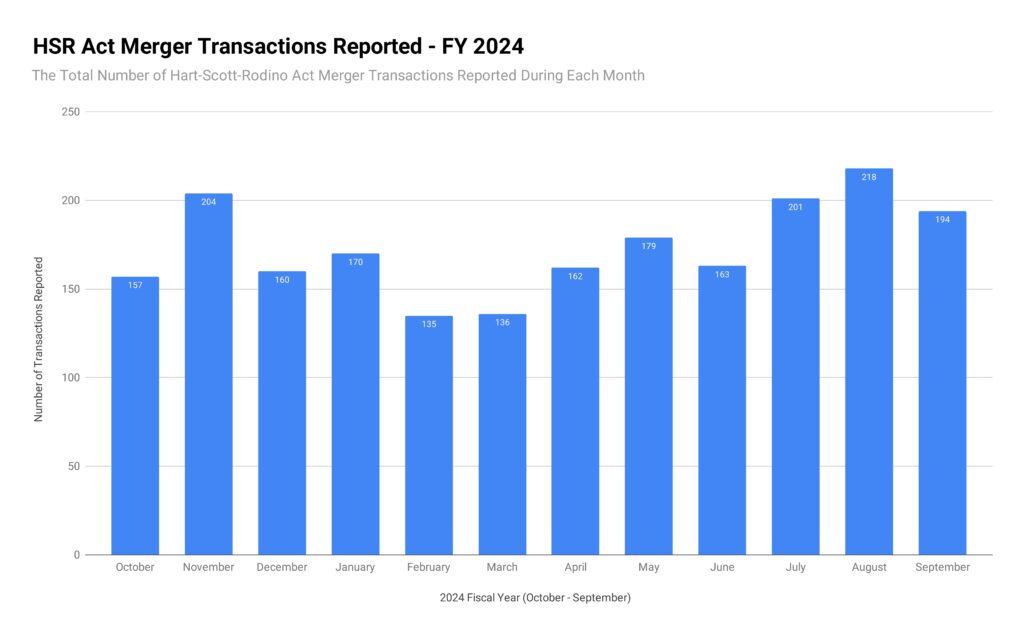

HSR Transactions by Month: Fiscal Year 2024

This chart details monthly HSR transactions reported during fiscal year 2024. Activity was generally steady, ranging from a low of 135 in February 2024 to a high of 233 in November 2024. The summer months were particularly active, with 201 filings in July and 218 in August, suggesting a seasonal push in deal execution. In total, 2,079 transactions were reported for the year, marking a stable and resilient M&A environment despite broader macroeconomic uncertainty. The monthly distribution illustrates a market characterized by strategic pacing rather than contraction.

HSR Transactions by Month: Fiscal Year 2023

This chart provides a breakdown of HSR transactions during fiscal year 2023. Monthly filings ranged from a low of 114 in April 2023 to a high of 207 in November 2022, with most months clustering between 140 and 190 filings. Overall, 1,805 transactions were reported, reflecting a market navigating economic adjustment and evolving deal dynamics. Despite moderate variability, the year demonstrated the resilience of M&A activity during a period shaped by inflationary pressures and shifting regulatory priorities.

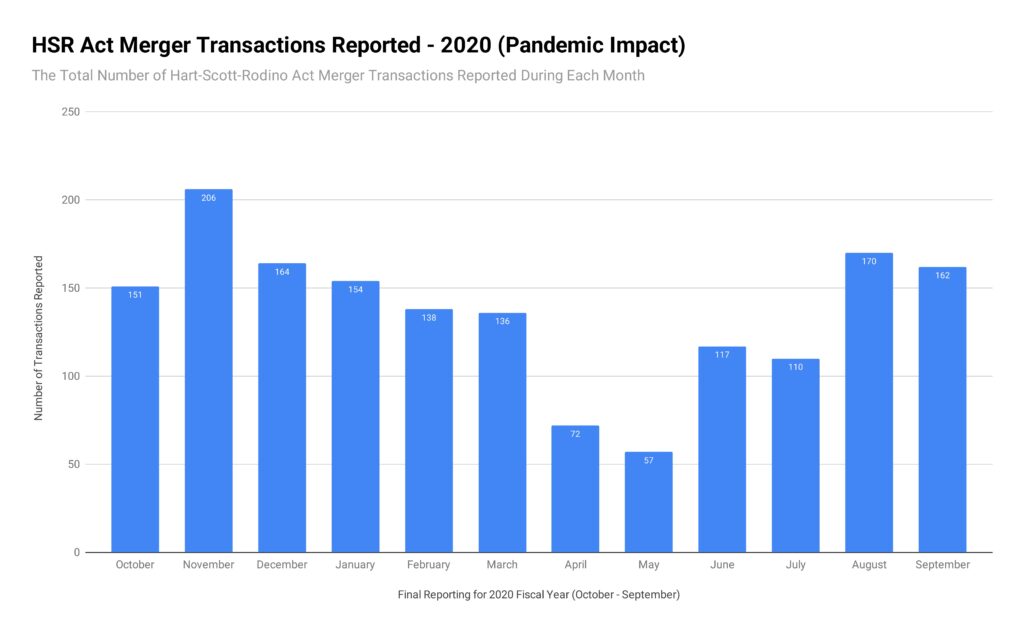

HSR Transactions by Month: Fiscal Year 2020 (Pandemic Impact)

This chart illustrates monthly HSR transactions during fiscal year 2020, a period defined by the onset of the global pandemic. Filings plunged to a low of 57 in May 2020 as uncertainty and lockdowns disrupted dealmaking. Activity rebounded later in the year, with filings reaching a high of 206 in November 2019 and stabilizing through the remainder of the fiscal year. In total, 1,637 transactions were reported, underscoring both the disruption and resilience of the M&A market during one of the most challenging economic periods in recent history. This snapshot highlights how external shocks can dramatically alter deal timing, while also revealing the market’s capacity for recovery.

Comparative Takeaway (2020–2025)

Taken together, these charts reveal a resilient and adaptive U.S. M&A landscape. The pandemic year (2020) highlighted the market’s vulnerability to sudden shocks, yet also demonstrated its rapid rebound capacity. FY23 and FY24 reflected steady deal activity amid economic adjustment, while FY25-to-date demonstrates a measured return to growth, with filings increasing steadily through the summer. The long-term data underscores that while deal volumes fluctuate with economic and regulatory cycles, the strategic imperative for M&A remains constant—driven by adaptation, consolidation, and the pursuit of growth.

Read the original report here.

About ComplexDiscovery OÜ

ComplexDiscovery OÜ is a highly recognized digital publication providing insights into cybersecurity, information governance, and eDiscovery. Based in Estonia, ComplexDiscovery OÜ delivers nuanced analyses of global trends, technology advancements, and the legal technology sector, connecting intricate issues with the broader narrative of international business and current events. Learn more at ComplexDiscovery.com.

News Sources

- Premerger Notification Program | Federal Trade Commission (ftc.gov)

- Personal Income and Outlays, June 2025 | U.S. Bureau of Economic Analysis (BEA)

- U.S. International Trade in Goods and Services, June 2025 | U.S. Bureau of Economic Analysis (BEA)

- Gross Domestic Product, 2nd Quarter 2025 (Advance Estimate) | U.S. Bureau of Economic Analysis (BEA)

- From Volatility to Vision: June 2025 HSR Filings Show Steady Strategic Focus (ComplexDiscovery)

Additional Reading

- HSR Act Reporting: A ComplexDiscovery Chronology

- FTC Annual Competition Reports (Hart-Scott-Rodino Act Reports)

Source: ComplexDiscovery OÜ

Assisted by GAI and LLM Technologies per EDRM GAI and LLM Policy.