[EDRM Editor’s Note: This article was first published here on January 9, 2024, and EDRM is grateful to Rob Robinson, editor and managing director of Trusted Partner ComplexDiscovery, for permission to republish.]

ComplexDiscovery Editor’s Note: This article offers a concise overview of the eDiscovery industry’s mergers, acquisitions, and investments from 2001 through 2024. With a focus on the transformative activity of 2024, it examines key trends, historical milestones, and the relationship between M&A activity and market growth. The listing of events in this report is based on publicly available information, and while it may not capture every transaction, it is representative of the majority of significant activities shaping the industry. Designed for legal professionals, technology innovators, and industry stakeholders, the report highlights the strategic drivers behind the sector’s evolution.

The eDiscovery industry in 2024 has proven to be another transformative year, with mergers, acquisitions, and investments driving significant shifts in the competitive and technological landscape. As the market matures, strategic activity remains central to the sector’s ability to meet evolving demands. This report begins with an analysis of 2024 M&A activity, explores broader trends since 2001, and examines how these trends align with market size growth from 2012 to the present.

2024: A Year of Strategic Activity

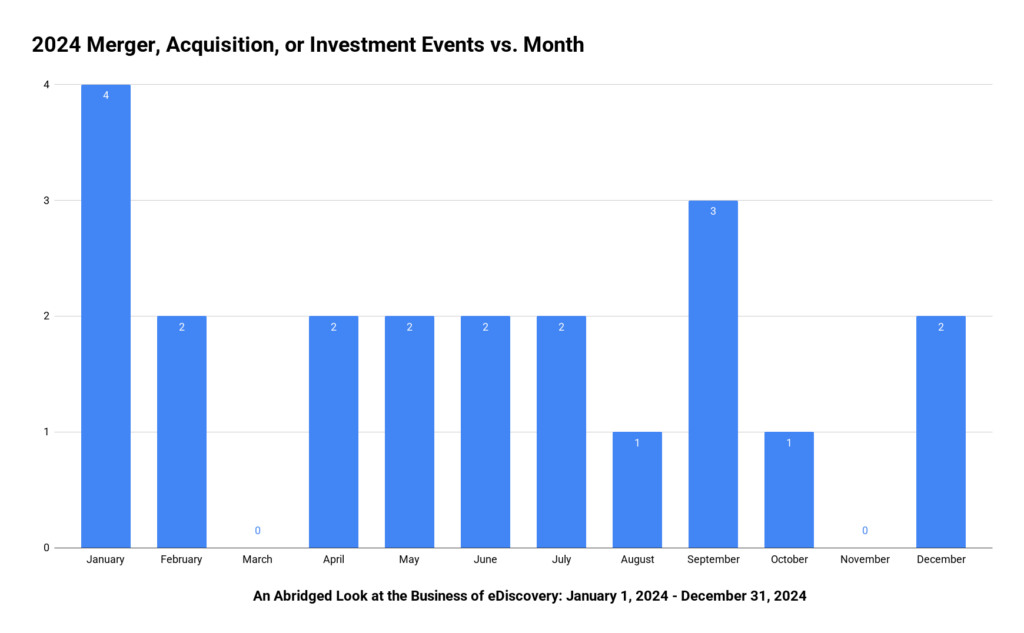

In 2024, the eDiscovery industry recorded 21 mergers, acquisitions, and investments. These transactions showcased the ongoing commitment of organizations to expand their technological capabilities, optimize operations, and address the growing complexity of legal and regulatory environments.

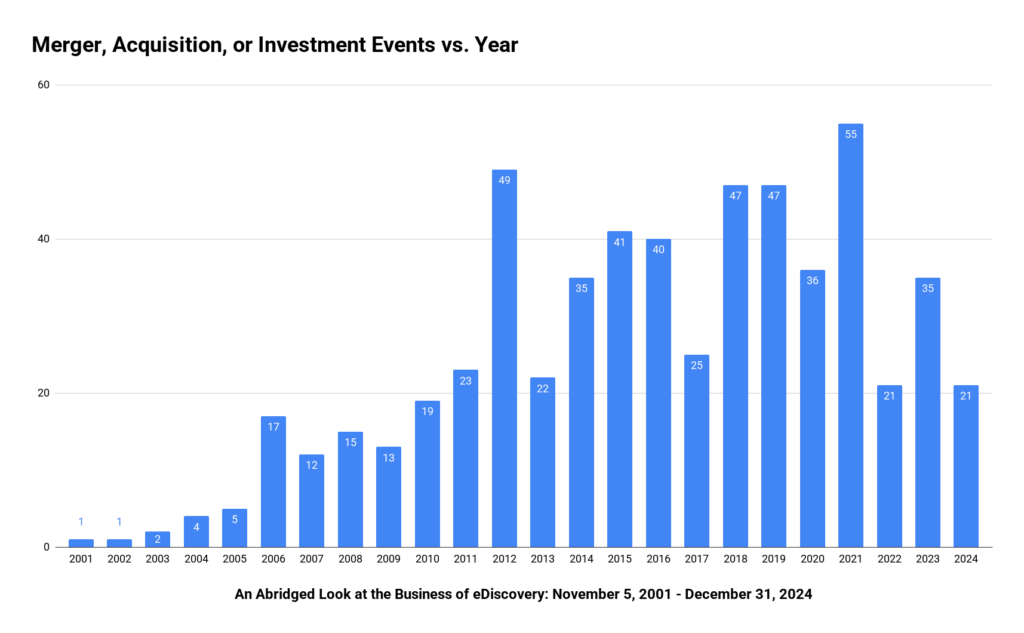

The eDiscovery sector’s journey from a single recorded merger in 2001 to 586 cumulative events by the close of 2024 illustrates the industry’s evolution.

Rob Robinson, Editor and Managing Director of ComplexDiscovery.

Complete Legal stood out as a key player in the early months of the year, starting with a merger with L2 Services and Precise Legal that solidified its position as a comprehensive service provider. Shortly afterward, the company acquired the eDiscovery unit of Frontline Managed Services, broadening its reach into managed services for law firms and corporate legal departments. These moves reflect Complete Legal’s strategic efforts to provide an integrated set of offerings tailored to modern litigation challenges.

Proteus Discovery Group also made headlines with its acquisition of Novitas Data in September. This acquisition enhanced Proteus’ ability to offer advanced data solutions, particularly for complex litigation and regulatory investigations. The deal underscores the increasing demand for specialized services that align with evolving legal technology needs.

Other standout deals of the year included Reveal’s acquisition of Onna Technologies, which marked a significant advancement in unstructured data management, and Harbor’s acquisition of Ascertus, highlighting the push for geographic expansion into Europe. ArcherHall further reinforced its leadership in digital forensics with acquisitions of Shephard Data Services and Vestige Digital Investigations, while Cognicion LLC strengthened its litigation support capabilities with the purchase of CodexTen.

Here is a summary of the significant M&A activity in 2024 by month:

- January: Complete Legal merged with L2 Services and Precise Legal, acquired the eDiscovery unit of Frontline Managed Services, and Translate.One acquired Balthasar.

- February: Harbor acquired Pinnacle, and Cohesity acquired Verital’s Data Protection Business.

- April: ArcherHall acquired Shephard Data Services, and Array acquired Ricoh USA’s eDiscovery Services Business.

- May: Reveal acquired Onna Technologies, and Elevate acquired CJK Group.

- June: ArcherHall acquired Vestige Digital Investigations, and Mitratech acquired HotDocs.

- July: Translate.One acquired Enable2, and KLDiscovery received significant investment from Carlyle Equity Opportunity GP and others.

- August: Cognicion LLC acquired CodexTen.

- September: Proteus Discovery Group acquired Novitas Data, Elevate acquired Redgrave Data, and Dilitrust acquired doeLEGAL.

- October: Harbor acquired Ascertus.

- December: Broad Sky Partners acquired Frontline Managed Services, and The Vertex Companies acquired LitCon Group.

These transactions highlight the industry’s focus on AI and automation, digital forensics, managed services, and geographic expansion as organizations navigate a rapidly evolving legal and regulatory environment.

A Historical Perspective: M&A Activity from 2001 to Today

The eDiscovery sector’s journey from a single recorded merger in 2001 to 586 cumulative events by the close of 2024 illustrates the industry’s evolution. The early 2000s were marked by limited activity as the industry took shape. In this foundational period, companies focused on building tools for email archiving and basic keyword search capabilities. The 2006 amendments to the Federal Rules of Civil Procedure (FRCP) acted as a catalyst, formally integrating electronically stored information into legal discovery processes. This regulatory shift spurred the first wave of consolidation as companies sought to expand their offerings to meet new compliance demands.

By the end of the 2010s, mergers and acquisitions began to accelerate, driven by technological advancements and increasing data volumes. The adoption of predictive coding, cloud-based platforms, and AI analytics transformed how organizations approached eDiscovery, leading to a surge in activity. Peak years like 2012, with 49 recorded events, and 2018 and 2019, with 47 events each, marked periods of heightened interest in scaling capabilities and integrating new technologies.

The pandemic era brought another wave of transformation. Remote work and the proliferation of virtual collaboration tools like Microsoft Teams and Slack created new challenges for data management. In 2021, the industry saw its highest-ever M&A activity with 55 deals, driven by the urgency of digital transformation. The focus during this period shifted toward acquiring cloud-native solutions and enhancing cybersecurity capabilities to address the complexities of distributed workflows and increasing data breaches.

Even as activity moderated post-pandemic, strategic consolidation has remained strong. Deals in recent years have been targeted, focusing on AI advancements, digital forensics, and compliance solutions, underscoring the industry’s commitment to innovation and specialization.

The Intersection of M&A Activity and Market Growth

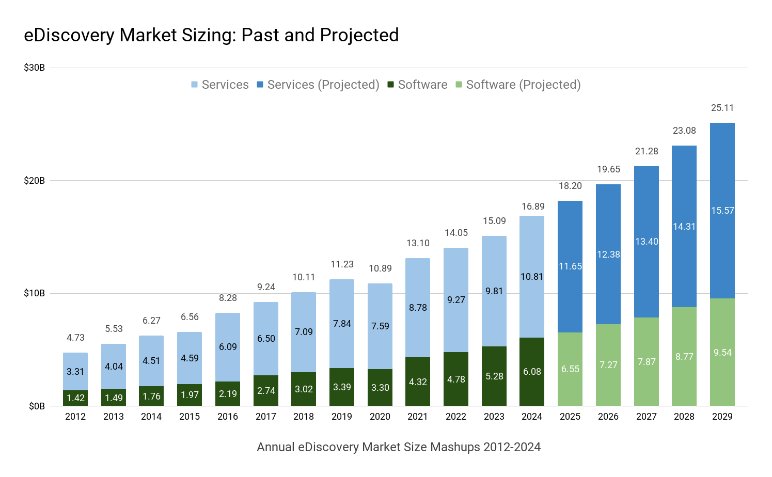

The growth of M&A activity in the eDiscovery sector has coincided with a substantial expansion in market size. From a total value of $4.73 billion in 2012 to $16.89 billion in 2024, the market has nearly quadrupled over the past decade. This growth reflects the rising importance of both software and services in managing the complexities of modern litigation and compliance.

The software segment, which has expanded from $1.42 billion in 2012 to $6.08 billion in 2024, has been driven by acquisitions focusing on advanced technologies. Companies have sought to enhance their offerings with tools for artificial intelligence, predictive coding, and cloud-based solutions. These technologies have become essential for automating time-consuming tasks such as document review, contract analysis, and data classification, improving efficiency and reducing costs in legal workflows.

The services segment has also experienced significant growth, increasing from $3.31 billion in 2012 to $10.81 billion in 2024. This expansion has been fueled by acquisitions targeting managed services, compliance solutions, and consulting expertise. The focus has been on addressing the growing demand for end-to-end solutions that combine data management, legal operations, and risk mitigation. Service providers have been particularly active in acquiring capabilities to handle complex litigation, cross-border compliance requirements, and information governance challenges.

The alignment of M&A activity with market growth highlights a strategic evolution in the industry.

Rather than pursuing high-volume transactions, companies have increasingly focused on acquisitions that deliver niche expertise or geographic expansion. The industry has seen a rise in deals emphasizing digital forensics, cybersecurity, and the integration of tools to manage collaboration data from platforms like Slack and Microsoft Teams. Additionally, the emphasis on AI and automation reflects the sector’s prioritization of innovation to stay competitive in a fast-changing regulatory and technological environment.

Reflections and Future Implications

The eDiscovery industry’s growth story is one of resilience and adaptation. From its early days of limited activity to the technologically advanced and globally integrated market it is today, the sector has consistently evolved to meet new challenges. As the industry looks to the future, the interplay between market size and M&A activity will continue to shape its trajectory. Stakeholders can expect continued emphasis on artificial intelligence, cloud-based solutions, and compliance technologies as the primary drivers of strategic activity in the years ahead.

Read the original article here.

About ComplexDiscovery OÜ

ComplexDiscovery OÜ is a highly recognized digital publication providing insights into cybersecurity, information governance, and eDiscovery. Based in Estonia, ComplexDiscovery OÜ delivers nuanced analyses of global trends, technology advancements, and the legal technology sector, connecting intricate issues with the broader narrative of international business and current events. Learn more at ComplexDiscovery.com.

News Sources

- A Running List of Industry M&A+I-Related Announcements

- An Abridged Look at the Business of eDiscovery: Mergers, Acquisitions, and Investments

- First Look: eDiscovery Market Size Mashup Highlights Growth from 2012 to 2029

Reported numbers may change as past events are identified and entered into the tracking database. Not all announcements are tracked as completed events.

Additional Reading

Source: ComplexDiscovery OÜ

Assisted by GAI and LLM Technologies per EDRM GAI and LLM Policy.