[EDRM Editor’s Note: This article was first published here on November 25, 2023 and EDRM is grateful to Rob Robinson, editor and managing director of ComplexDiscovery, for permission to republish.]

ComplexDiscovery Editor’s Note: Within this report lies a nuanced forecast of the eDiscovery market, suggesting its course from 2023 to 2028. While the detailed analysis meticulously outlines the growth in aggregate and across distinct segments, an underlying theme resonates throughout the advent of generative artificial intelligence (GenAI) and its anticipated influence on the sector.

Although not explicitly detailed in each section, the implications of GenAI’s transformative power are woven into the fabric of the report’s projections. It is an invisible yet potent force expected to usher in a new era of efficiency and innovation within eDiscovery. The potential for GenAI to redefine the contours of the market is significant, with its capacity to automate complex tasks and unlock new levels of analytical depth. Readers should infer GenAI’s impact as a constant undercurrent that promises to propel the market forward, reshaping strategies and operational efficiencies.

Source Note: Taken from a combination of public market sizing estimations* as shared in leading electronic discovery publications, posts, data points, and discussions, and developed by ComplexDiscovery OÜ market models beginning in 2012, the following eDiscovery Market Size Mashup** shares general market sizing estimates for the software and services area of the electronic discovery market for the years between 2023 and 2028.

Industry Research

The Next Five Years in eDiscovery: Market Size Forecast for 2023-2028

ComplexDiscovery Staff

This comprehensive report delves into the eDiscovery market, providing a detailed analysis of its size and growth from 2023 to 2028. It examines the market in aggregate and segmented into software and services, providing insights into the Compound Annual Growth Rates (CAGR) and shifts in market shares.

ComplexDiscovery.

In an era where digital data proliferates at an unprecedented rate, the eDiscovery market has become a critical component in the legal, corporate, and government sectors. This comprehensive report delves into the eDiscovery market, providing a detailed analysis of its size and growth from 2023 to 2028. It examines the market in aggregate and segmented into software and services, providing insights into the Compound Annual Growth Rates (CAGR) and shifts in market shares. The narratives presented herein reflect the current state of the market and project the trends expected to shape the future of eDiscovery. As organizations navigate through vast quantities of data for legal and regulatory purposes, understanding these trends is paramount for strategic decision-making and maintaining a competitive edge.

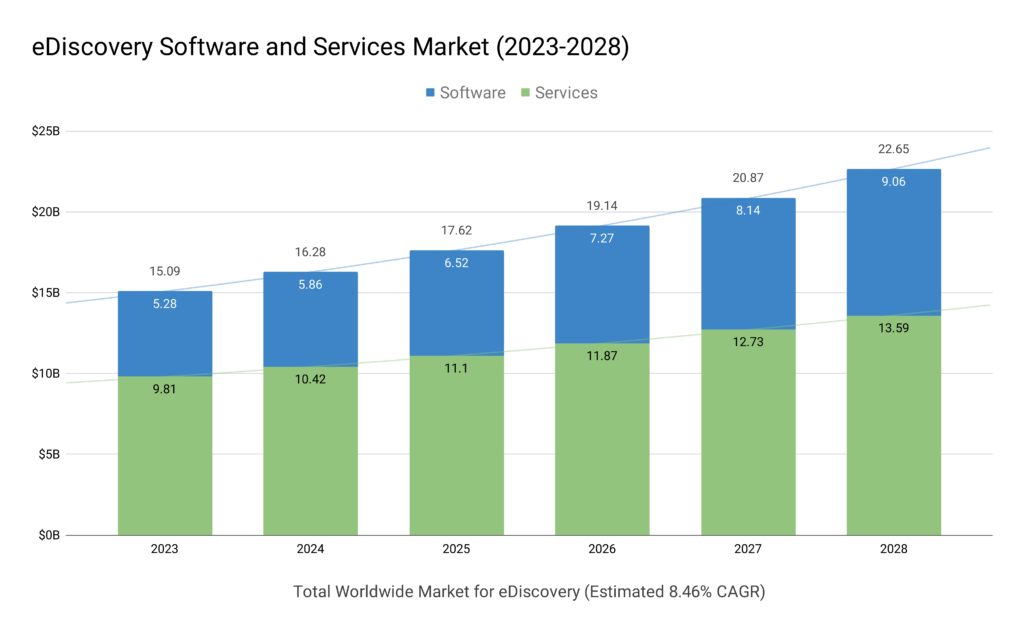

eDiscovery Market Size and Trends: Aggregate, Software, and Services (Figures 1, 2, and 3)

Aggregate Market Growth

The eDiscovery market is set to experience steady growth from 2023 through 2028. The aggregate market size is anticipated to grow from $15.09 billion to $22.65 billion, with a Compound Annual Growth Rate (CAGR) of 8.46%. This solid growth trajectory highlights the increasing significance of eDiscovery across various legal, corporate, and government activities, driven by the burgeoning volume of data and the escalating need for efficient data management and analysis.

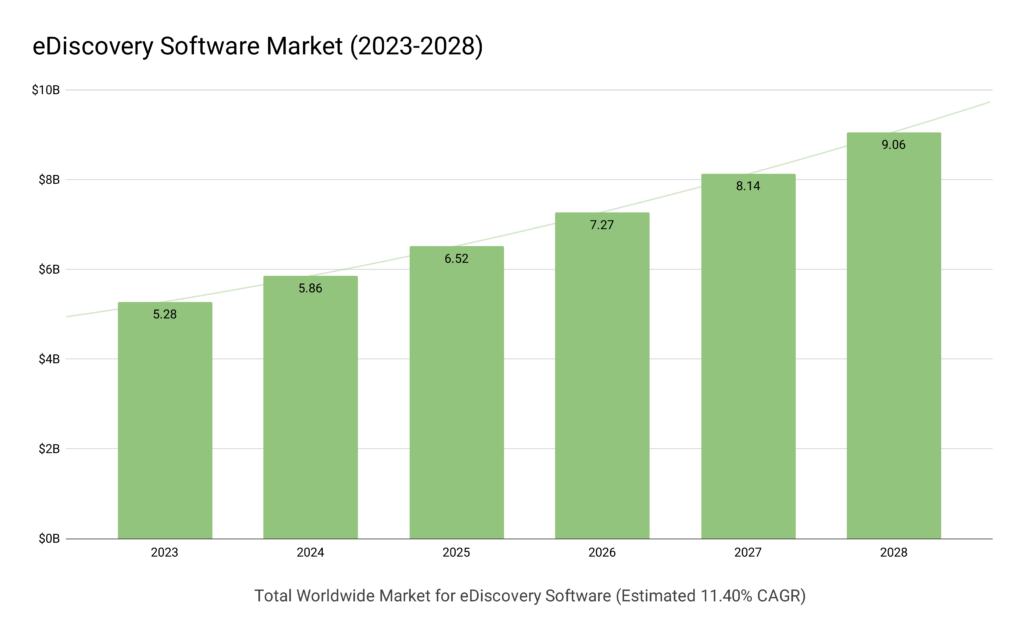

Software (SW) Segment Growth

The software segment of the eDiscovery market is forecasted to grow at an even more impressive CAGR of 11.40%, reflecting the rapid technological advancements in the field. Starting at $5.28 billion in 2023, the market size for eDiscovery software is projected to reach $9.06 billion by 2028. This significant growth can be attributed to the rising demand for sophisticated eDiscovery platforms that offer enhanced analytics, artificial intelligence, and machine learning capabilities to streamline the review and analysis of large datasets.

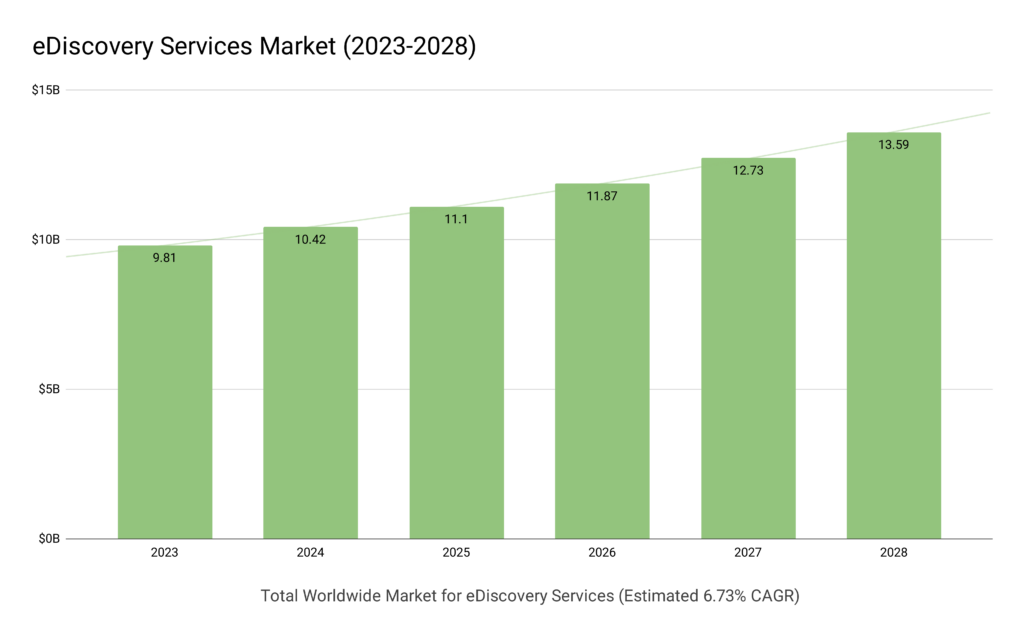

Services Segment Growth

While the services segment grows at a slower rate than software, with a CAGR of 6.73%, it maintains a larger share of the overall market.

The total market size for eDiscovery services is expected to increase from $9.81 billion in 2023 to $13.59 billion in 2028. The services segment includes consulting, managed services, and support, which remain in high demand as legal and regulatory complexities increase and organizations seek specialized expertise to navigate eDiscovery challenges.

Percentage Share of Software and Services

In terms of market composition, the share of eDiscovery software is projected to increase from 35% in 2023 to 40% in 2028, while services are expected to decrease from 65% to 60% of the market share. This shift underscores a market that is becoming more software-driven as end-users increasingly adopt technology solutions to automate and enhance various aspects of the eDiscovery process.

The overall market expansion and the shift towards a greater reliance on software solutions reflect the evolving nature of eDiscovery. The market is responding to the need for greater efficiency and advanced analytical capabilities to handle the growing complexity and volume of data. These trends suggest a vibrant eDiscovery industry that is adapting to meet the changing demands of the digital age, with significant opportunities for both established players and new entrants in the software and services domains.

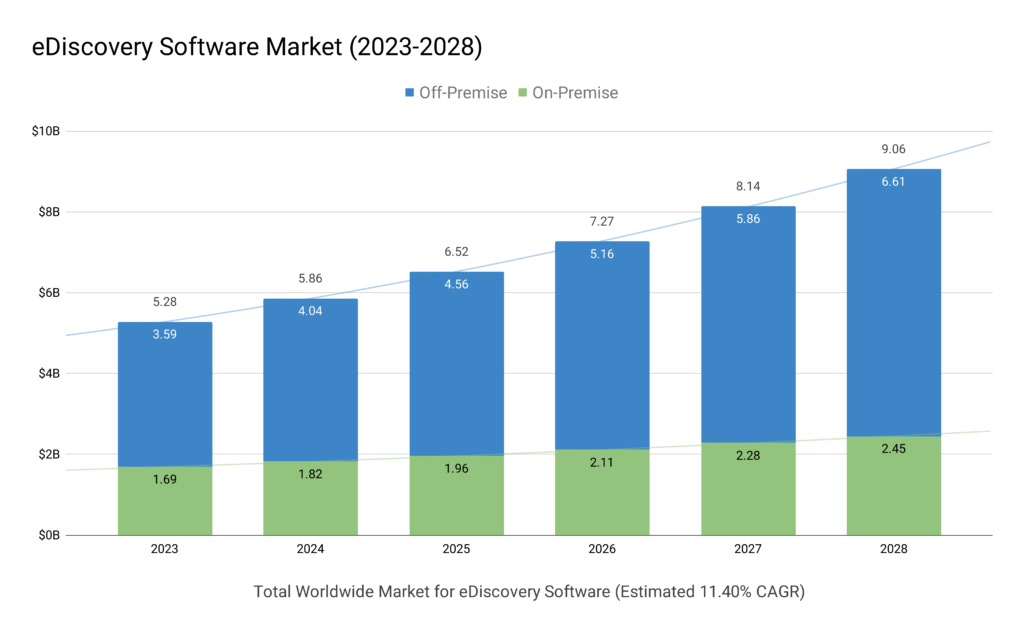

On and Off-Premise Software Market (Figure 4)

The landscape of eDiscovery software solutions shows a clear trend towards off-premise or cloud-based offerings over traditional on-premise installations. This shift is reflected in the changing percentages of market share between the two types of software deployment.

In 2023, on-premise software accounts for 32% of the market. However, this is expected to steadily decrease to 27% by 2028. In contrast, off-premise software is set to grow from holding 68% of the market in 2023 to a dominant 73% by 2028.

ComplexDiscovery.

In 2023, on-premise software accounts for 32% of the market. However, this is expected to steadily decrease to 27% by 2028. In contrast, off-premise software is set to grow from holding 68% of the market in 2023 to a dominant 73% by 2028. This growth indicates a growing preference for cloud-based eDiscovery solutions, which may be attributed to their scalability, cost-effectiveness, and the increasing comfort level of organizations with cloud security.

In terms of spending, the total market size for on-premise eDiscovery software is expected to rise from $1.69 billion in 2023 to $2.45 billion in 2028. Although this represents a growth in dollar value, it is modest compared to the surge in off-premise software spending, which is forecasted to jump from $3.59 billion in 2023 to $6.61 billion in 2028. The off-premise software’s growth in spending by almost $3 billion over five years significantly outpaces that of on-premise solutions, further emphasizing the market’s shift towards cloud-based services.

The increase in off-premise software spending suggests that the eDiscovery industry is embracing the flexibility and accessibility that cloud solutions provide. This increase could be driven by the growing volumes of data managed in eDiscovery, the distributed nature of modern workforces requiring remote access, and the ongoing digital transformation trends across the legal sector.

The trajectory for eDiscovery software is straightforward: off-premise, cloud-based solutions are on the rise, reshaping how legal professionals approach the discovery process. Service providers in this space will likely continue to innovate and invest in their off-premise offerings to meet their clients’ rising demand and evolving expectations.

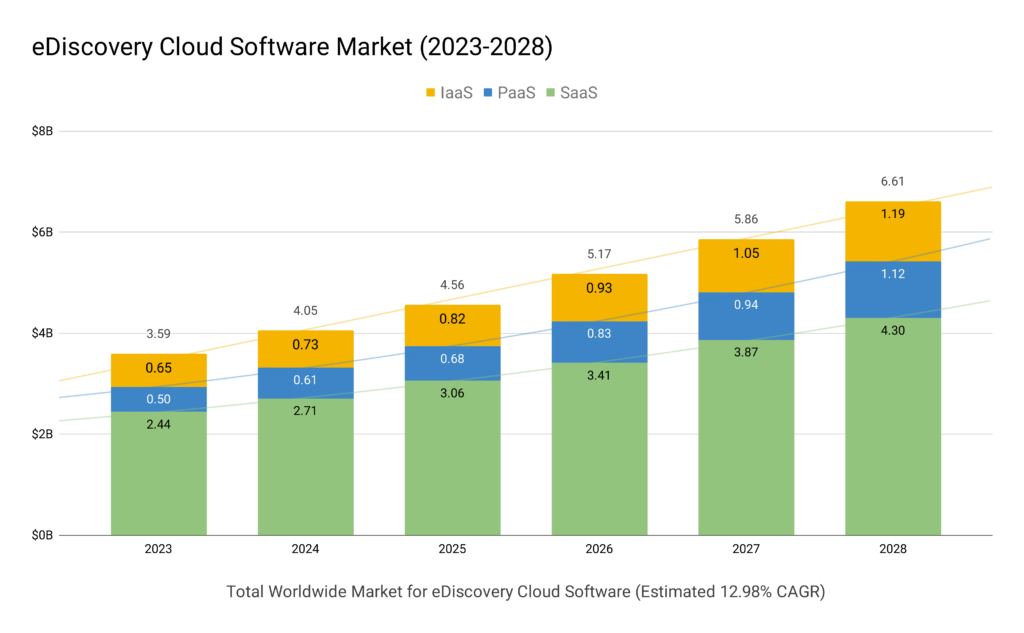

Cloud Software (Off-Premise) Market (Figure 5)

The Cloud Software segment within the eDiscovery market, comprising software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS), is showing interesting trends in its composition and growth.

Software as a Service (SaaS) is the leading contributor to the cloud software segment’s revenue. However, its percentage of total off-premise spending is expected to slightly decline from 68% in 2023 to 65% by 2028. Despite this slight decrease in market share percentage, the total spending on SaaS is projected to increase significantly from $2.44 billion to $4.30 billion in the forecast period. This robust increase underscores the continued adoption and reliance on SaaS offerings within the eDiscovery realm, likely due to the convenience, scalability, and cost-efficiency they offer to law firms and corporate legal departments.

Platform as a Service (PaaS) shows a gradual increase in its market share percentage, from 14% in 2023 to an anticipated 17% by 2028. In line with this, the spending on PaaS is forecasted to double, growing from $0.50 billion in 2023 to $1.12 billion in 2028.

ComplexDiscovery.

Platform as a Service (PaaS) shows a gradual increase in its market share percentage, from 14% in 2023 to an anticipated 17% by 2028. In line with this, the spending on PaaS is forecasted to double, growing from $0.50 billion in 2023 to $1.12 billion in 2028. This growth trajectory suggests an increasing preference for platforms that offer developers the tools and components to build and manage custom applications, which are becoming more critical as eDiscovery processes become more data-intensive and complex.

Infrastructure as a Service (IaaS) maintains a steady 18% share of the cloud software market throughout the forecast period, with total spending expected to rise from $0.65 billion in 2023 to $1.19 billion in 2028. The consistent share and steady growth in spending on IaaS reflect the foundational role that infrastructure services play in supporting the entire eDiscovery process, from data storage to processing and analysis.

The overall growth in cloud software spending indicates the broader trend towards cloud-based eDiscovery solutions. This move is fueled by the legal industry’s growing comfort with cloud security, the need for scalable resources to handle fluctuating data volumes, and the desire for more cost-effective and flexible software deployment options.

As cloud computing continues to mature and become more ubiquitous, we can expect eDiscovery professionals to increasingly leverage cloud-based services to manage the complexities of the discovery process more efficiently. The growth in PaaS and IaaS also points to a market that is becoming more sophisticated, as users not only consume software but also build and manage their applications and infrastructure in the cloud.

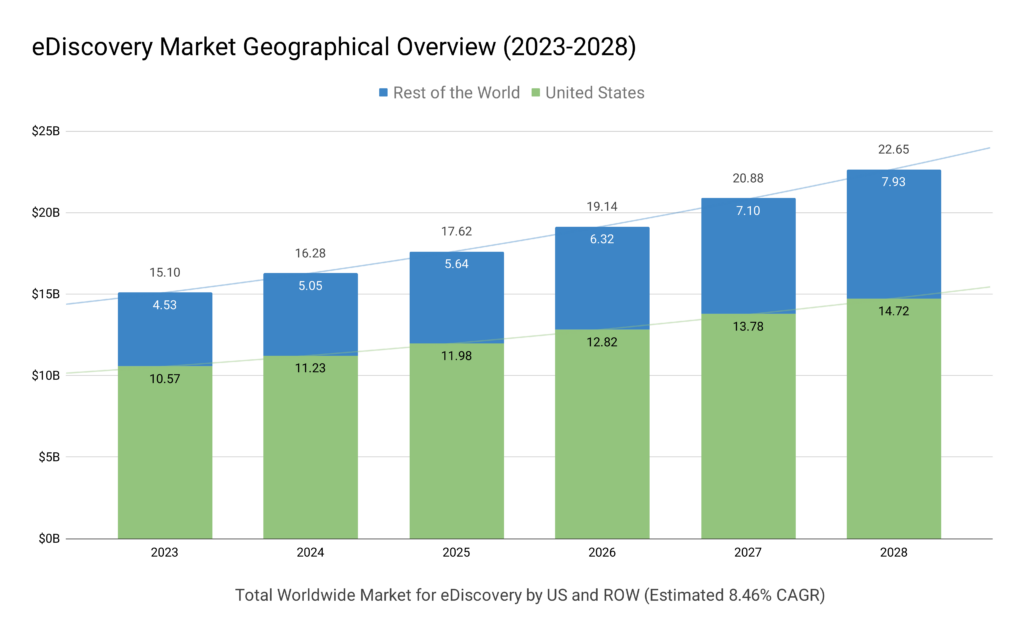

Geographical Market Size (Figure 6)

The eDiscovery market is seeing a dynamic shift in its geographical composition. The United States, traditionally the largest market for eDiscovery services, is forecasted to decrease its relative market share gradually from 2023 to 2028. In 2023, the US market share stands at 70%, expected to reduce to 65% by 2028. This 5% shift over the five years suggests a maturation of the US market and possibly a saturation of eDiscovery service offerings.

In 2023, the US market share stands at 70%, expected to reduce to 65% by 2028. This 5% shift over the five years suggests a maturation of the US market and possibly a saturation of eDiscovery service offerings. Conversely, the Rest of the World (ROW) market is anticipated to increase its share from 30% to 35% over the same period.

ComplexDiscovery.

Conversely, the Rest of the World (ROW) market is anticipated to increase its share from 30% to 35% over the same period. This uptick reflects the globalizing nature of legal services and the expanding adoption of eDiscovery technologies and practices in international markets. Emerging markets, increased global data regulations, and international litigation activities may drive this growth.

Despite the decreasing percentage of market share, the total market size in the US shows a robust upward trajectory, with the market expected to grow from $10.57 billion in 2023 to $14.72 billion in 2028. This growth translates to an approximate 39% increase over the forecasted period, indicating a healthy expansion in absolute terms. This growth suggests that while the US’s share of the global market may be shrinking, the overall demand for eDiscovery within the US is growing significantly, likely driven by the increasing complexity of legal cases, the growth of data, and the adoption of new technologies such as AI and machine learning in the legal sector.

The combined picture is one of a global eDiscovery market that is growing in size and becoming more distributed across international boundaries. This trend could signal an opportunity for eDiscovery service providers to expand their global footprint and for legal professionals to increase their cross-border competencies and capabilities.

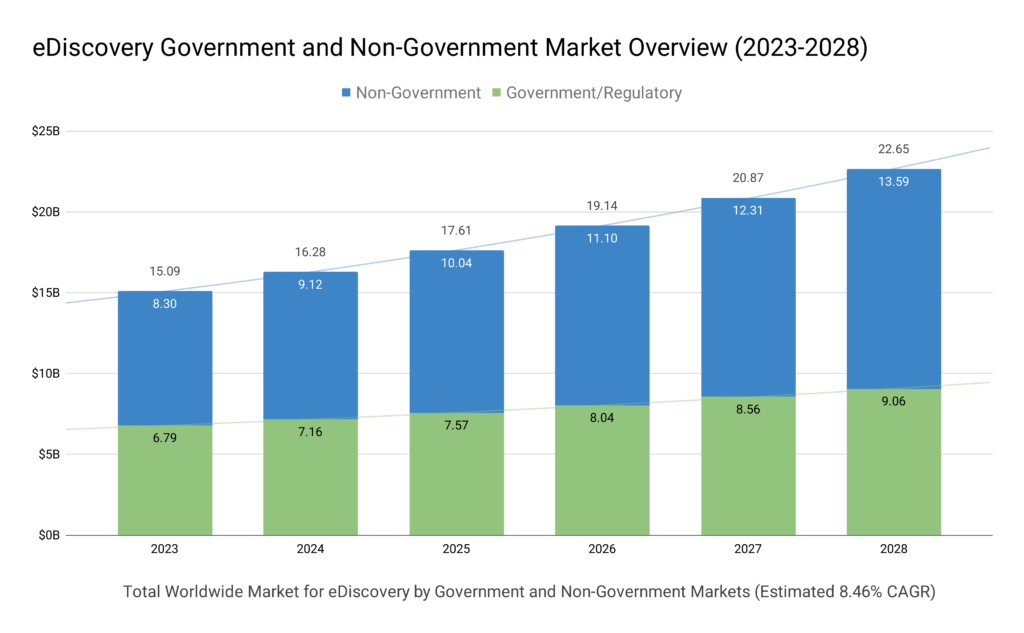

Government and Non-Government Market Size (Figure 7)

The eDiscovery market is bifurcated into government/regulatory and non-government segments, each demonstrating distinct trends in terms of market share and total spending.

Government/Regulatory Segment

The government/regulatory segment’s proportion of the market is on a gradual decline, moving from 45% in 2023 to an anticipated 40% by 2028. Despite this relative decrease, absolute government/regulatory sector spending is projected to grow from $6.79 billion in 2023 to $9.06 billion in 2028. This uptrend indicates that while the government’s proportionate market size is shrinking relative to the non-government sector, the actual investment in eDiscovery tools and services is increasing. This increase could be due to the rising volume of data involved in regulatory actions and litigations, increased emphasis on compliance and governance, and the modernization of government IT infrastructure.

Non-Government Segment

Conversely, the non-government segment’s market share is expected to increase from 55% in 2023 to 60% by 2028. The spending in this segment is forecasted to see a more pronounced rise from $8.30 billion to $13.59 billion over the same period. This robust growth can be attributed to the large-scale adoption of eDiscovery solutions in the private sector, driven by corporate litigations, internal investigations, and compliance requirements. As businesses continue to digitize their operations and face complex legal challenges, their reliance on eDiscovery solutions intensifies.

…non-government segment’s market share is expected to increase from 55% in 2023 to 60% by 2028…

ComplexDiscovery.

The diverging trends between the two segments highlight the dynamic nature of the eDiscovery market. While both sectors are growing in terms of absolute market size, the non-government sector is expanding more rapidly, likely due to the scalability and agility offered by eDiscovery solutions that are becoming increasingly critical in the face of fast-paced business environments and complex data landscapes.

The steady growth within the government sector underscores the ongoing need for robust eDiscovery practices amidst an environment of heightened regulatory scrutiny. At the same time, the accelerated growth in the non-government sector suggests that enterprises are becoming the main drivers of innovation and revenue within the eDiscovery market. As the volume and variety of data sources continue to expand, the importance of eDiscovery tools and services is set to become even more pronounced across both segments.

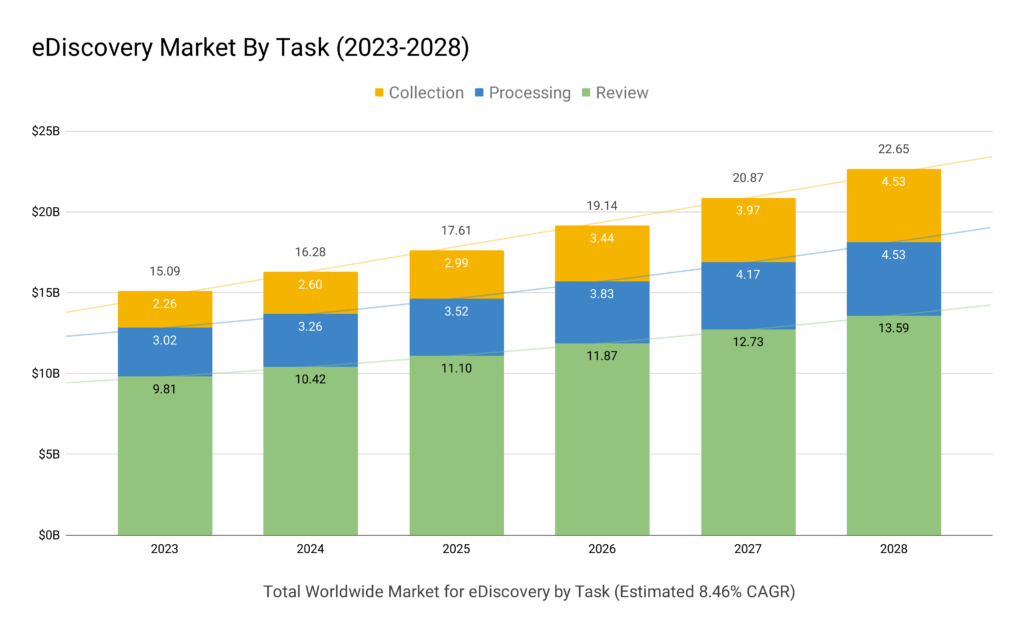

Estimated Spending by eDiscovery Task (Figure 8)

The eDiscovery market’s spending patterns reveal telling insights when segmented by task—Review, Processing, and Collection. Each task is a critical component of the eDiscovery process, but their shares of total spending are shifting, reflecting evolving priorities and technological advancements in the field.

This indicates that while technology and efficiencies may be reducing the relative cost of review as part of the total eDiscovery spend, the absolute cost is growing due to the increasing volume and complexity of data needing review.

ComplexDiscovery.

Review

The Review task commands the largest share of eDiscovery spending, although its percentage is forecasted to decrease from 65% in 2023 to 60% by 2028. In terms of dollar value, however, the spending on review is expected to see a significant rise from $9.81 billion to $13.59 billion. This indicates that while technology and efficiencies may be reducing the relative cost of review as part of the total eDiscovery spend, the absolute cost is growing due to the increasing volume and complexity of data needing review. This trend underscores the ongoing challenge of sifting through vast amounts of data to find relevant information and the importance of investing in sophisticated review tools and technologies.

Processing

Spending on processing maintains a consistent 20% of the total eDiscovery task spending across the forecast period. The total spending on processing is projected to increase from $3.02 billion in 2023 to $4.53 billion by 2028. This steady growth reflects the critical nature of processing in preparing data for review and analysis and suggests a stable demand for services that can handle increasingly complex data types and formats.

Collection

The Collection task is expected to grow its market share from 15% in 2023 to 20% by 2028. This is reflected in the total spending, which is projected to double from $2.26 billion to $4.53 billion. The increase in both percentage and spending points to the growing recognition of the importance of effective data collection practices, particularly as data sources become more diverse and dispersed. With the advent of new data types and the expansion of data creation points, the need for sophisticated collection tools and services that can navigate complex digital environments is becoming more pronounced.

These shifting spending patterns reflect the evolving nature of the eDiscovery market. While the review continues to take up the majority of resources, there is a notable shift towards investing in the collection, which could be indicative of the market’s response to the ever-expanding universe of data that organizations must manage. This also suggests that eDiscovery practitioners are investing more in the early stages of the eDiscovery process, recognizing that efficient collection can significantly streamline subsequent phases, such as review and processing.

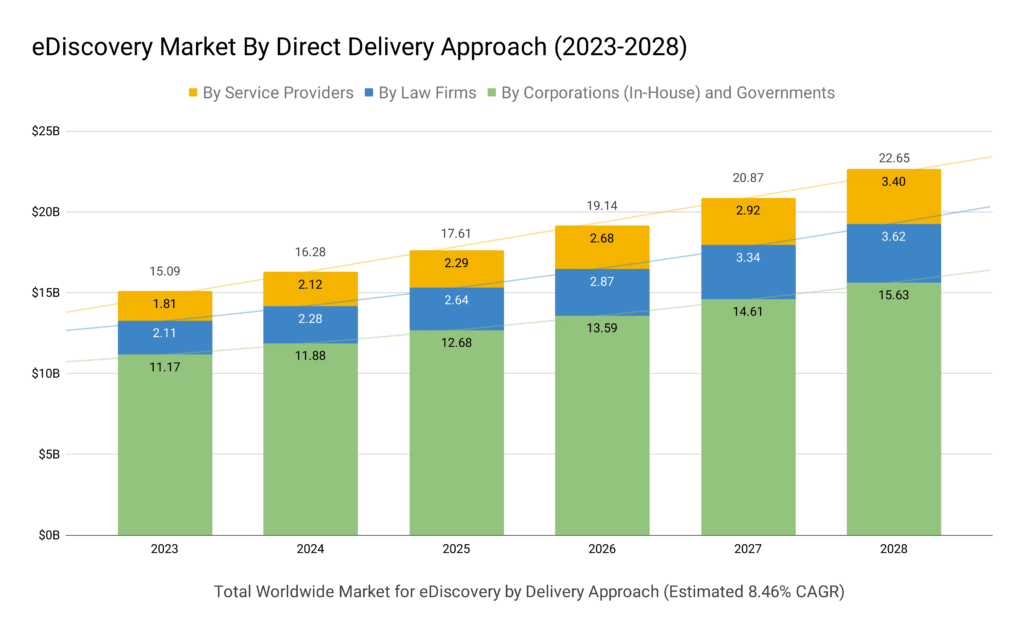

Estimated Direct Delivery by Provider (Figure 9)

The distribution of eDiscovery tasks by different providers indicates how the landscape of eDiscovery is managed across corporations, law firms, and service providers. The data reflects a shift in where the work is completed, with corporations and governments currently handling the majority of eDiscovery tasks directly.

Delivery by Corporations and Governments

Corporations and government entities are the most significant contributors to eDiscovery delivery, although their relative share is forecasted to decline from 74% in 2023 to 69% by 2028. Despite this decrease in percentage, the total spending by corporations and governments is expected to grow from $11.17 billion to $15.63 billion. This growth suggests an increasing volume of work being conducted in-house due to factors such as the rise in regulatory scrutiny, a greater emphasis on privacy, and the need for quicker access to data.

Delivery by Law Firms

Law firms consistently represent a smaller portion of eDiscovery delivery, with their share expected to increase slightly from 14% to 16% over the forecast period. The spending by law firms on eDiscovery tasks is anticipated to grow from $2.11 billion to $3.62 billion. This increase reflects the growing complexity of legal work, the specialization of law firms in managing intricate cases, and the expansion of legal services to include more comprehensive eDiscovery capabilities.

Direct Delivery by Service Providers

Service providers are projected to see a gradual increase in their market share from 12% to 15% by 2028, with total spending increasing from $1.81 billion to $3.40 billion. This trend indicates a growing reliance on specialized eDiscovery service providers, who offer expertise in managing and analyzing large datasets, as well as advanced technology solutions that may not be available in-house.

Total Providers Delivery

The total spending on delivery by all providers is expected to rise from $15.09 billion to $22.65 billion, reflecting the overall growth of the eDiscovery market. This substantial increase suggests that despite the relative shifts in delivery by different providers, the demand for eDiscovery services is on a solid upward trajectory.

The trends in delivery indicate a nuanced eDiscovery ecosystem where in-house capabilities are being bolstered in corporations and governments, law firms are deepening their eDiscovery practices, and service providers are carving out a larger role due to their specialized offerings. This dynamic points to a future where the collaboration between various types of eDiscovery providers becomes increasingly important to handle the scale and complexity of discovery in the digital age.

Closing Summary: The Next Five Years in eDiscovery

The eDiscovery market is on the cusp of significant transformation. The period from 2023 to 2028 is expected to witness substantial growth, driven by the increasing complexity of data management and the need for sophisticated analysis tools. This report has traversed the eDiscovery market landscape, highlighting the aggregate growth within software and services. It has shed light on the rising prominence of software solutions and the steady demand for specialized eDiscovery services. As we look towards the future, it is clear that the industry will continue to evolve, influenced by technological innovation and the growing demands of an increasingly digital legal environment. Stakeholders in the eDiscovery market should consider these insights to strategize for the years ahead, ensuring they are well-equipped to meet the challenges and opportunities that lie on the horizon.

Potential Impact of Generative AI on the eDiscovery Market

As we enter the age of generative artificial intelligence (GenAI), its potential to disrupt the eDiscovery market warrants a focused discussion. GenAI stands to revolutionize data analysis and management by introducing unprecedented efficiencies across various market segments. The integration of GenAI into eDiscovery tools and services can dramatically streamline processes, reduce manual labor, and expedite the delivery of results.

Impact on Aggregate Market

The adoption of GenAI across the eDiscovery market is expected to enhance the aggregate market’s productivity. By automating complex tasks such as document classification, pattern recognition, and predictive coding, GenAI can significantly reduce the time and resources required for data processing. This efficiency can lead to cost reductions and faster turnaround times, potentially increasing the volume of eDiscovery work that can be handled within the same time frames and budgets.

Impact on Software (SW) Segment

Within the software segment, GenAI is poised to offer sophisticated analytical capabilities that could greatly refine the process of sifting through large data sets. GenAI-powered software can learn from data to improve its performance over time, leading to increasingly accurate identification of relevant documents. This could shift the software segment’s CAGR upward as firms and organizations increasingly seek out these advanced capabilities to gain a competitive edge.

Impact on Services Segment

For the services segment, GenAI can act as a force multiplier. Service providers equipped with GenAI technologies can offer enhanced services, such as predictive analytics and intelligent case assessments, which could result in the segment capturing a larger market share than currently projected. By reducing the human effort required for repetitive tasks, GenAI allows legal professionals to focus on more strategic activities, thereby increasing the value and appeal of eDiscovery services.

The integration of GenAI into the eDiscovery market is not a matter of if but when. Its impact is anticipated to be transformative across all segments, driving efficiencies and creating opportunities for innovation. As we look to the future, market players should consider GenAI as a critical element in their strategic planning, preparing for a landscape where speed, accuracy, and efficiency are greatly enhanced by these advanced technologies. Those who embrace GenAI early may find themselves at the forefront of a new era in eDiscovery, leading the charge toward a more efficient and effective digital legal process.

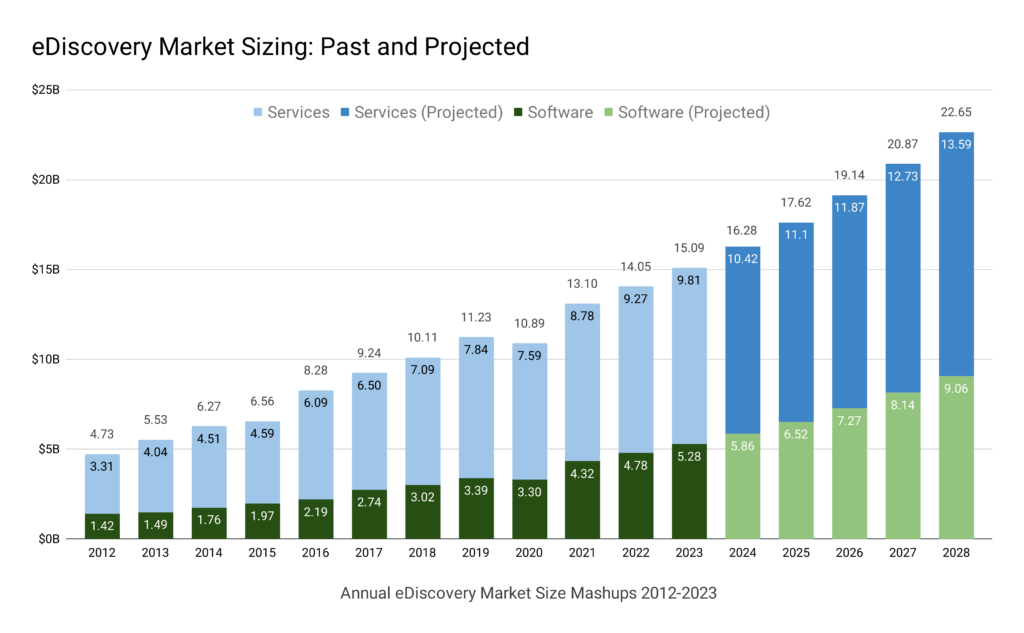

Lagniappe: Narrative on the Growth of the eDiscovery Software and Services Market 2012-2028 (Figure 10)

From 2012 to 2028, the eDiscovery market, encompassing both software and services, exhibited significant growth. This period marks a transformative era, reflecting the increasing reliance on digital data in legal and regulatory frameworks.

Software Segment Growth

The software segment of the eDiscovery market has shown a remarkable Compound Annual Growth Rate (CAGR) of approximately 12.28%. Starting from a spend of $1.42 billion in 2012, it has steadily risen to a projected $9.06 billion by 2028. This substantial growth underscores the evolving technological landscape in eDiscovery, with software solutions becoming increasingly sophisticated. The integration of advanced analytics, artificial intelligence, and machine learning has driven this segment, reflecting a shift towards more efficient, automated, and accurate data processing and analysis.

Services Segment Growth

The services segment, while growing at a slightly slower pace, has still demonstrated a significant CAGR of approximately 9.23%. From a spend of $3.31 billion in 2012, it is expected to reach $13.59 billion by 2028. This growth can be attributed to the expanding complexity of legal cases, the proliferation of data sources, and the increasing need for specialized expertise in data management and analysis. The services sector has continued to play a crucial role, providing the necessary support, consultation, and managed services integral to the eDiscovery process.

Total Market Growth and CAGR

Over the span from 2012 to 2028, the total market spend in eDiscovery has reached approximately $211.67 billion, with a combined CAGR of around 10.28%. This reflects the overall expansion of the eDiscovery market, driven by both technological advancements and the growing demand for comprehensive legal and regulatory data management.

The Future Through the Lens of the Past

The evolution of the eDiscovery market from 2012 to 2028 paints a picture of an industry adapting to and growing with the increasing digitalization of information. The substantial growth in both software and services segments highlights the escalating importance and complexity of eDiscovery in the modern age. With the market continuing to expand, stakeholders in the legal, corporate, and government sectors must stay abreast of these trends, leveraging the advancements in technology and services to meet their evolving needs.

The mashup charts (Figures 1-10) represent one interpretation of aggregated and modeled available information that focuses on eDiscovery market trends, size, growth, and segmentation.

Figure 1 – eDiscovery Software and Services Market

Figure 2 – eDiscovery Software Market

Figure 3 – eDiscovery Services Market

Figure 4 – eDiscovery Software by Off-Premise and On-Premise Market

Figure 5 – Cloud Software for Off-Premise Market

Figure 6 – eDiscovery Market Overview by Geography

Figure 7 – eDiscovery Market Overview by Government/Non-Government Markets

Figure 8 – eDiscovery Market Overview by Task

Figure 9 – Estimated Direct Delivery by Provider

Figure 10 – [Lagniappe] eDiscovery Market Sizing: Past and Projected

*Market Size Sources

Sources for eDiscovery market sizing estimations and recent adjustments have been aggregated since the initial eDiscovery Market Size Mashup published in 2012 and are included in a model that is used to develop annual eDiscovery market size mashups. These sources include but are not limited to publicly available content (including abstracts, excerpts, quotes, references, and data points) from the following sources.

- ComplexDiscovery. 2023 eDiscovery Business Confidence Surveys. (Running Listing). November 2023.

- Selected Industry eDiscovery Providers (Discussions), 2023. Research, Reports, and Interviews. November 2023.

- U.S. Bureau of Economic Analysis (Department of Commerce), 2023. Gross Domestic Product (Advance Estimate), Third Quarter 2023. October 26, 2023.

- Harvard Business Review. Navigating the Jagged Technological Frontier: Field Experimental Evidence of the Effects of AI on Knowledge Worker Productivity and Quality (Working Paper). Dell’Acqua et. al. September 2023.

- IDC. IDC Market Forecast: Worldwide eDiscovery and Forensics Applications Software Forecast, 2023-2027. Ryan O’Leary, June 2023.

- IDC. IDC Media Release: Worldwide Spending on IT and Business Services. April 2023.

- Industry Research. Global eDiscovery Industry Research Report 2023. January 2023.

- Prescient Strategic Intelligence. eDiscovery Market Size and Analysis. November 2022.

- ComplexDiscovery. 2022 eDiscovery Business Confidence Surveys. (Running Listing). November 2022.

- Selected Industry eDiscovery Providers (Discussions), 2022. eDiscovery Market Trends and Trajectories. November 2022.

- U.S. Bureau of Economic Analysis (Department of Commerce), 2022. Gross Domestic Product (Advance Estimate), Third Quarter 2022. October 27, 2022.

- Research and Markets. eDiscovery Market Research Report by Deployment, Component, Verticals, Region, Global Forecast to 2027 – Cumulative Impact of COVID-19.360iReseearch, October 2022.

- Gartner. Market Guide for E-Discovery Solutions. Michael Hoeck, October 2022.

- IDC. IDC MarketScape: Worldwide Review Software 2022 Vendor Assessment. Ryan O’Leary, October 2022.

- Allied Market Research. Global eDiscovery Market: Opportunities and Forecast 2021 – 2031. G Akansha, G Ankit, K Vineet. September 2022.

- IDC. IDC MarketScape: Worldwide eDiscovery Early Case Assessment Software 2022 Vendor Assessment. Ryan O’Leary, September 2022.

- 360 Market Updates. Global eDiscovery Industry Research Report – Competitive Landscape, Market Size, Regional Status, and Prospect. September 2022.

- Houlihan Lokey. Legal Technology and Services Q3 Update. August 2022

- Research and Markets. 2022. eDiscovery Market – Forecasts from 2021 to 2026. Knowledge Sourcing Intelligence LLP, December 2021.

- ComplexDiscovery. Annual eDiscovery Market Size Mashups – 2012 – 2022. November 21, 2021.

- Reports and Data. 2021. eDiscovery Market Size Expected to Reach USD 31.89 Billion at CAGR of 12.3%, By 2028. November 7, 2021.

- ComplexDiscovery. 2021 eDiscovery Business Confidence Surveys. (Running Listing). November 2021.

- Research and Markets. 2021. eDiscovery Market Research Report by Deployment, Component, Verticals, and Region – Global Forecast to 2026 – Cumulative Impact of COVID-19. October 2021.

- U.S. Bureau of Economic Analysis (Department of Commerce), 2021. Gross Domestic Product (Advance Estimate), Corporate Profits, And GDP By Industry, Third Quarter 2021. October 28, 2021.

- Nasdaq. 2021. LegalTechnology: Why the Legal Tech Boom is Just Getting Started. Casey Flaherty and Jae Um. October 11, 2021.

- Research and Markets. 2021. eDiscovery Market Trends, Share, Size, Growth, Opportunity and Forecast 2021 – 2026. September 2021.

- BMC. 2021. The State of SaaS in 2022: Growth Trends and Statistics. Laura Shriff and Chrissy Kidd. September 17, 2021.

- EY. 2021. Top Five eDiscovery Trends in 2021. Harshavardhan Godugula. August 31, 2021.

- Nuix. 2021. FY21 Financial Results Investor Presentation. August 31, 2021.

- Securities and Exchange Commission. 2021. Form S-1 Statement for CS Disco, Inc. June 25, 2021.

- ComplexDiscovery. 2021. Summer 2021 eDiscovery Pricing Survey Results. June 6, 2021.

- eDiscovery Journal. 2021. A Different Perspective on eDiscovery Market Size. Greg Buckles. April 6, 2021.

- Facts and Factors. 2021. Global Market Size and Share will Reach USD $24.12 Billion by 2026. February 10, 2021.

- Market and Markets. 2021. eDiscovery Market worth $12.9B by 2025. January 2021.

- Third-Party Market Studies (Independent Briefing). 2021. Industry Overview for eDiscovery Technology. May 2021.

- Third-Party Market Studies (Independent Briefing). 2021. eDiscovery Sector Update. April 2021.

- Securities and Exchange Commission. 2021. Form 10-K Statement for KLDiscovery, Inc. March 18, 2021.

- ComplexDiscovery. Annual eDiscovery Market Size Mashups – 2012 – 2021. November 11, 2020.

- American Medical Association. 2020. The Year Ahead—Exclusive Interview With Anthony Fauci, MD, NIAID Director. November 7, 2020.

- U.S. Bureau of Economic Analysis (Department of Commerce), 2020. Gross Domestic Product (Advance Estimate), Corporate Profits, And GDP By Industry, Third Quarter 2020. October 29, 2020.

- ComplexDiscovery. “Resetting the Baseline? eDiscovery Market Size Adjustments for 2020.” October 26, 2020.

- U.S. Bureau of Economic Analysis (Department of Commerce), 2020. Gross Domestic Product (Third Estimate), Corporate Profits (Revised), And GDP By Industry, Second Quarter 2020. September 30, 2020.

- Selected Industry eDiscovery Analysts (Discussion), 2020. eDiscovery Market Forecasting. October 19, 2020.

- ComplexDiscovery. “2020 eDiscovery Business Confidence Surveys. (Running Listing).” October 2020.

- Industry eDiscovery Providers (Discussion), 2020. eDiscovery Market Forecasting. September 29, 2020.

- IDC. “Worldwide eDiscovery Services Forecast, 2020-2024.” Ryan O’Leary. September 2020.

- Selected Industry Investors (Discussion), 2020. eDiscovery Market Forecasting. September 15, 2020.

- KL Discovery. “KL Discovery Inc. Announces Second Quarter Financial Results.” KL Discovery. August 12, 2020.

- IDC. “Worldwide eDiscovery Software Forecast, 2020-2024.” Ryan O’Leary. June 2020.

- ComplexDiscovery. “Home or Away? New eDiscovery Market Sizing and Pricing Considerations.” June 15, 2020.

- Mordor Intelligence. 2020. Global Digital Forensics Market, 2020–2025. May 2020.

- ComplexDiscovery. “Summer 2020 eDiscovery Pricing Survey Results.” May 2020.

- ComplexDiscovery. “Revisions and Decisions? New Considerations for eDiscovery Secure Remote Reviews.” May 4, 2020.

- Selected Industry eDiscovery Providers (Discussion), 2020. eDiscovery Market Forecasting. May 1, 2020.

- ComplexDiscovery. “2019 eDiscovery Business Confidence Surveys. (Running Listing).” November 2019.

- Relativity Fest Panel. “State of the eDiscovery Union.” Panelist Ryan O’Leary (IDC). October 22, 2019.

- IDC. “IDC Marketscape: Worldwide eDiscovery SaaS Review Software Assessment.” Ryan O’Leary. August 12, 2019.

- Gartner, Inc. “Market Guide for E-Discovery Solutions.” Julian Tirsu, Michael Hoeck. June 27, 2019.

- ComplexDiscovery. “Summer 2019 eDiscovery Pricing Survey Results.” June 2019.

- KL Discovery. “Investor Presentation.” Pivotal, KL Discovery. May 2019.

- Gartner, Inc. “Defining Your E-Discovery Process Will Lower Costs and Reduce Risks.” Julian Tirsu. March 29, 2019.

- Georgetown Law Center for the Study of the Legal Profession and the Thomson Reuters Legal Executive Institute. “2019 Report on the State of the Legal Market.” January 2019.

- ComplexDiscovery. “Winter 2019 eDiscovery Pricing Survey Results.” December 2018.

- ComplexDiscovery. “2018 eDiscovery Business Confidence Surveys. (Running Listing).” November 2018.

- FRONTEO. “Form 20-F (073118).” UBIC Annual Report for Foreign Investors. July 2018.

- IDC. “Worldwide eDiscovery Software Forecast, 2018-2022.” Ryan O’Leary, Sean Pike. June 2018.

- Markets and Markets. “eDiscovery Market by Component, Deployment Type, Organizational Size, Vertical, and Region – Global Forecast to 2023.” June 2018.

- Georgetown Law Center for the Study of the Legal Profession and the Thomson Reuters Legal Executive Institute. “2018 Report on the State of the Legal Market.” January 2018.

- Greentarget. “2018 Legal Industry Outlook.” January 2018.

- Catalyst Investors. “Legal Tech Market Overview.” Kirk Mahoney. November 29, 2017.

- Gartner, Inc. “Market Guide for E-Discovery Solutions.” Julian Tirsu, Garth Landers, Shane Harris. October 24, 2017.

- P&S Market Research. “eDiscovery Market for Software and Services.” October 18, 2017.

- ComplexDiscovery. eDiscovery Business Confidence Surveys – Running Listing. ComplexDiscovery. October 18, 2017.

- Forbes. “Global Legal Tech Is Transforming Service Delivery.” Mark A. Cohen. August 29, 2017.

- Aberdeen. “Key Strategies To Improve The Performance Of E-Discovery Teams.” Michael Caton. August 2017

- IDC. “Worldwide eDiscovery Services Market Shares, 2016: Global Leaders Emerge Through Industry Consolidation.” Angela Gelnaw. June 2017.

- ACG Partner. “Legal Tech: Seeded and Ready to Launch.”, Trevor Martin, Ben Howe, Jon Guido, Fred Joseph. April 2017.

- IDC. “Marketscape: Worldwide eDiscovery Services 2017 Vendor Assessment.” Angela Gelnaw. March 2017.

- ComplexDiscovery. Annual eDiscovery Market Size Mashups – 2012 – 2017, ComplexDiscovery, March 4, 2017.

- Zion Market Research. “eDiscovery Market for Government, Regulatory Agencies, Enterprises, and Law Firms.” November 23, 2016.

- Markets and Markets. “E-Discovery Market by Solution, Service, Deployment Type, and Vertical – Global Forecast to 2021.” November 2016.

- Future Market Insights (FMI). “eDiscovery Market Analysis – Global Industry Analysis and Opportunity Assessment.” July 5, 2016.

- IDC. “Worldwide eDiscovery Software Market Forecast, 2016-2020: Back to Basics.” Angela Gelnaw. June 30, 2016.

- Gartner, Inc. “Market Guide for E-Discovery Solutions.” Jie Zhang. June 30, 2016.

- U.S. Department of Commerce, International Trade Administration. “2016 Top Markets Report – Cloud Computing.” April 14, 2016.

- IDC. “Worldwide eDiscovery Services Forecast 2014-2019.” Sean Pike, Angela Gelnaw. December 2015.

- Gartner, Inc. “Critical Capabilities for E-Discovery Software.” Jie Zhang, Garth Landers. October 6, 2015.

- Transparency Market Research. “eDiscovery Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2014-2022.” July 6, 2015

- Markets and Markets. “E-Discovery Market By Solution, Deployment, Industry, & Region – Global Forecast to 2020.” July 2015.

- Global Industry Analysts, Inc. “eDiscovery (Software and Services) Global Strategic Business Report.” May 28, 2015.

- Gartner, Inc. “Magic Quadrant for E-Discovery Software.” Jie Zhang, Garth Landers. May 18, 2015.

- The Radicati Group. “eDiscovery Market, 2014-2018.” Sara Radicati. December 3, 2014.

- Transparency Market Research. “eDiscovery Market – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2014-2020).” June 2014.

- Gartner, Inc. “Magic Quadrant for E-Discovery Software.” Jie Zhang, Debra Logan, Garth Landers. June 19, 2014.

- IDC. “Worldwide eDiscovery Software 2014-2018 Forecast.” Sean Pike. May 2014.

- The Radicati Group. “eDiscovery Market, 2013-2017.” Sara Radicati. August 2013.

- Gartner, Inc. “Magic Quadrant for E-Discovery Software.” Debra Logan, Alan Dayley, Sheila Childs. June 10, 2013.

- The Radicati Group. “eDiscovery Market, 2012-2016.” Sara Radicati, Todd Yamasaki. October 2012.

- Transparency Market Research. “World e-Discovery Software & Service Market Study.” August 2012.

- Rand Institute For Civil Justice. “Where the Money Goes: Understanding Litigant Expenditures for Producing Electronic Discovery.” Nicolas Pace and Laura Zakaras. April 2012.

- IDC. “MarketScape: Worldwide Standalone Early Case Assessment Applications Vendor Analysis.” Vivian Tero. September 19, 2011.

- Industry Observer Estimations (Multiple Observers)

Assisted by GAI and LLM Technologies per EDRM GAI and LLM Policy.

Additional Reading

- An eDiscovery Market Sizing Chronology from ComplexDiscovery

- Defining Cyber Discovery? A Definition and Framework

**What is a Mashup?

A mashup is a combination or mixing of content from different sources to create a new way of looking at data. The main characteristic of a mashup includes combinations, visualizations, and aggregation. Mashups can help make existing data more useful, moreover for personal and professional use. (Wikipedia)

Source: ComplexDiscovery