[EDRM Editor’s Note: This article was first published here on October 2, 2023 and EDRM is grateful to Rob Robinson, editor and managing director of ComplexDiscovery, for permission to republish.]

[ComplexDiscovery Editor’s Note: The eDiscovery Business Confidence Survey is a non-scientific quarterly survey that shares insight into the business confidence of individuals working in the eDiscovery ecosystem. The survey consists of core questions on factors related to the creation, delivery, and consumption of eDiscovery products and services purposed toward cyber, data, and legal discovery tasks, including the introduction of three new AI-centric questions in this iteration of the survey. Additionally, the survey contains optional questions focused on the business operational metrics of days sales outstanding (DSO), monthly recurring revenue (MRR), and customer revenue distribution.

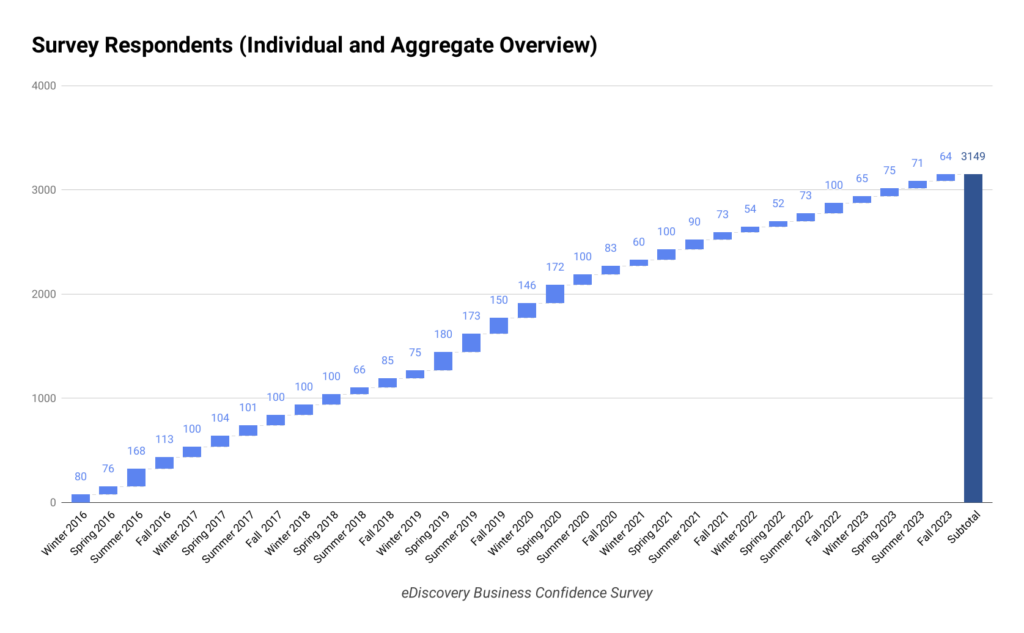

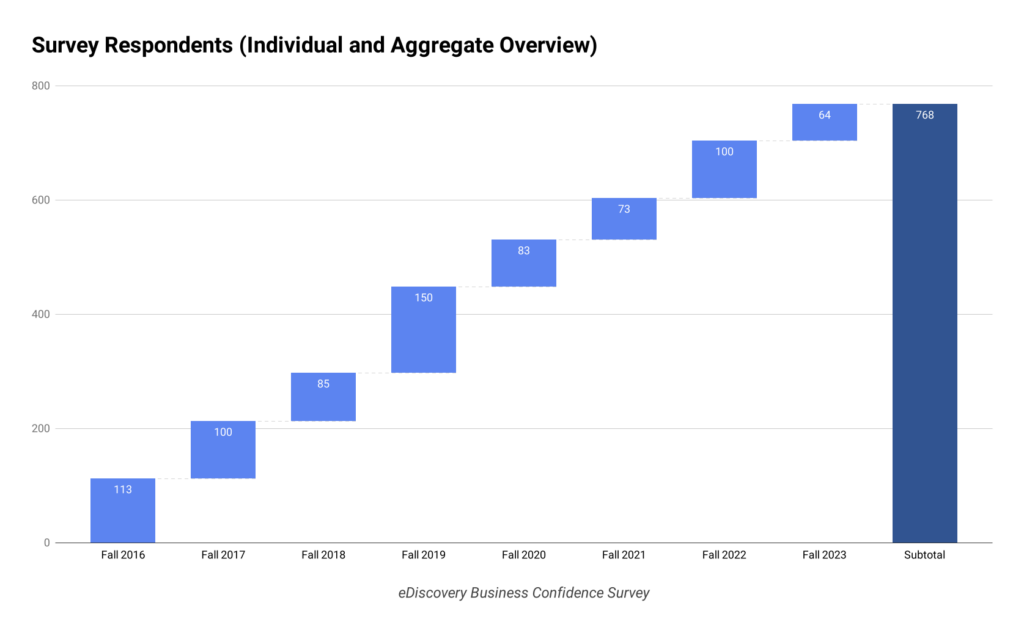

Background Note: The eDiscovery Business Confidence Survey is a well-established, quarterly research initiative designed to provide insights into the state of business confidence in the eDiscovery ecosystem. Since its inception, the survey has been administered 32 times, drawing approximately 100 respondents per survey and totaling 3,149 responses in aggregate. This consistent pulse check has played a pivotal role in understanding industry sentiment, capturing trends in revenue and profit, and identifying the key challenges faced by eDiscovery professionals.

The Fall 2023 edition of this quarterly survey was administered between September 11 and September 28, 2023. The promotion of the survey was primarily handled through direct emails* from ComplexDiscovery, with the support of survey advocates like the EDRM, eDiscovery Today, and other leading eDiscovery organizations. This inclusive promotion approach ensured a broad and diverse range of respondents, making the findings representative and insightful. The Fall 2023 survey saw participation from 64 industry professionals.]

Industry Survey

The Fall 2023 Survey: A First Look

ComplexDiscovery Staff

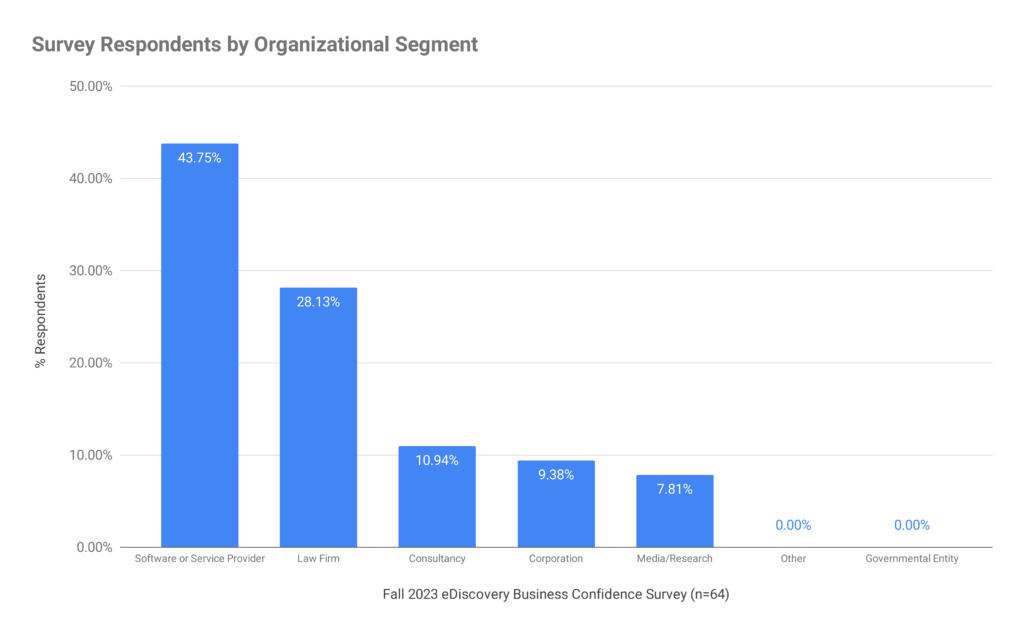

The Fall 2023 survey encapsulated a diverse range of organizational segments. The majority of the respondents were from Software and/or Services Providers (43.75%) and Law Firms (28.13%). Consultancies (10.94%) and Corporations (9.38%), and Media/Research Organizations (7.81)%.

In terms of the level of support, the survey represents a balanced cross-section of the industry. Executive Leadership made up the largest group at 35.94%, closely followed by Operational Management at 32.81%. Tactical Execution respondents made up the balance of respondents at 31.25%.

Key Takeaways from the Fall 2023 eDiscovery Business Confidence Survey

The Fall 2023 eDiscovery Business Confidence Survey polled industry professionals to gauge business outlook and perspectives on integrating large language models (LLMs) and generative AI. Here are some of the key insights:

Cautiously Optimistic Business Outlook

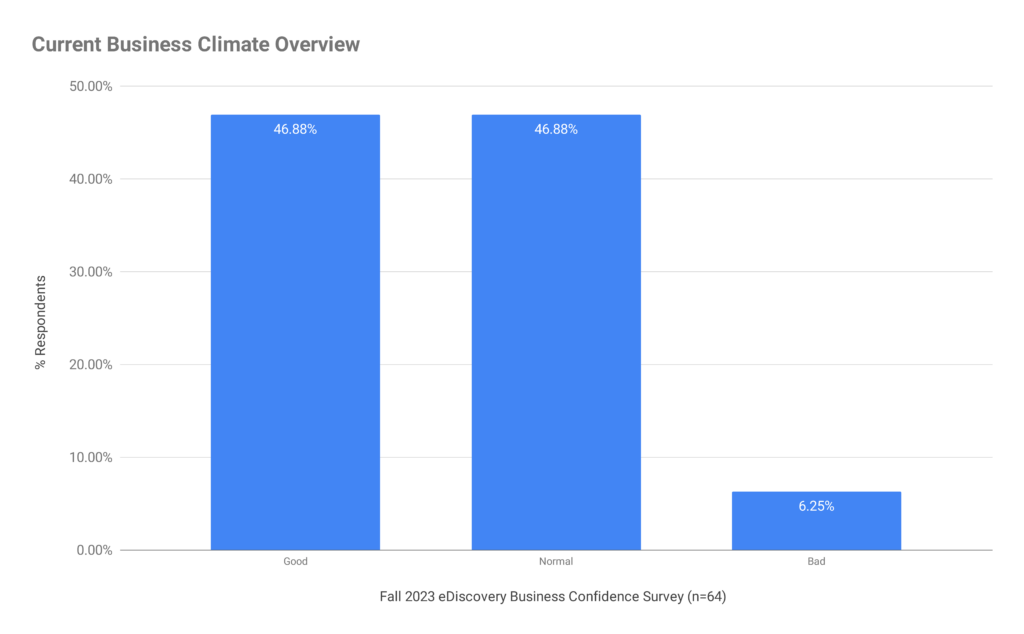

- 46.88% rated current business conditions as good, with another 46.88% calling them normal. Only 6.25% felt conditions are bad.

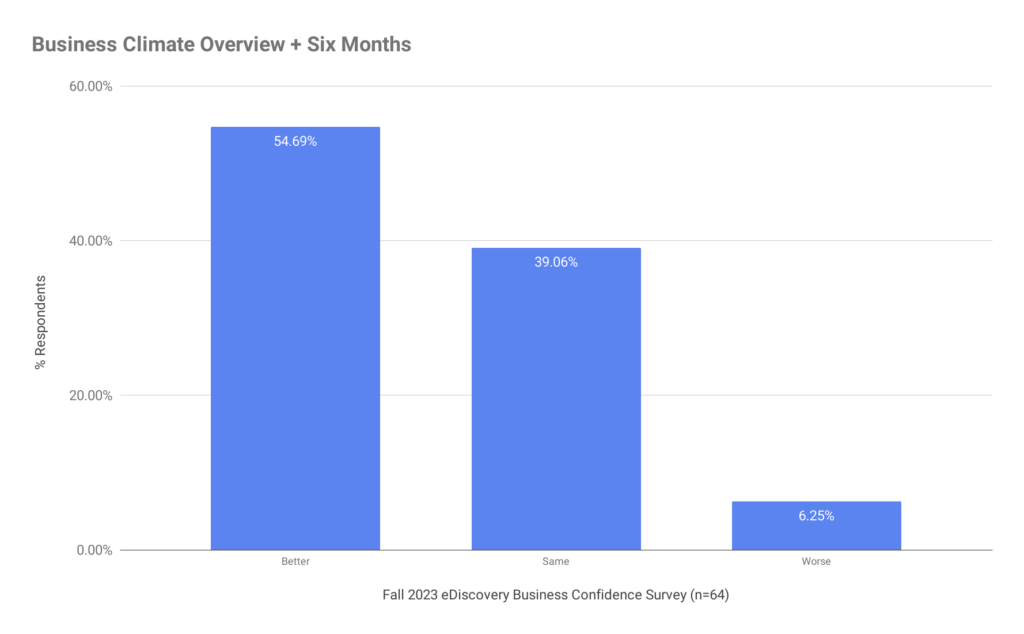

- For the next six months, 54.69% expect conditions to improve, while 39.06% see conditions remaining the same. Just 6.25% expect worse conditions.

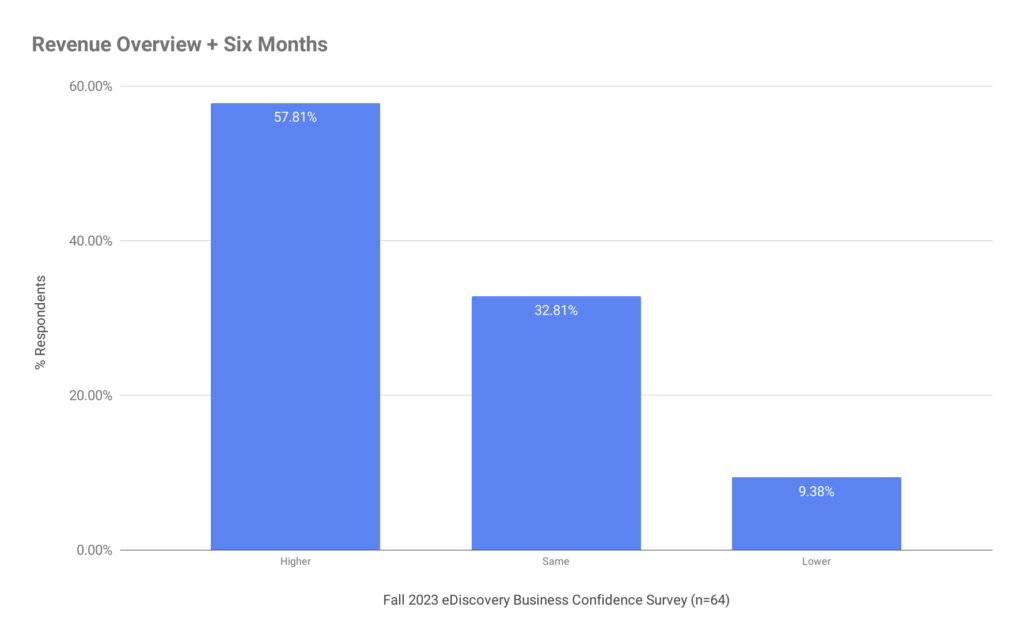

- The positive outlook extends to revenue and profits, with strong majorities expecting increases over the next six months.

This suggests most industry professionals have a cautiously optimistic outlook heading into the final quarter of 2023. While not overly confident, most see steady business conditions and growth opportunities ahead.

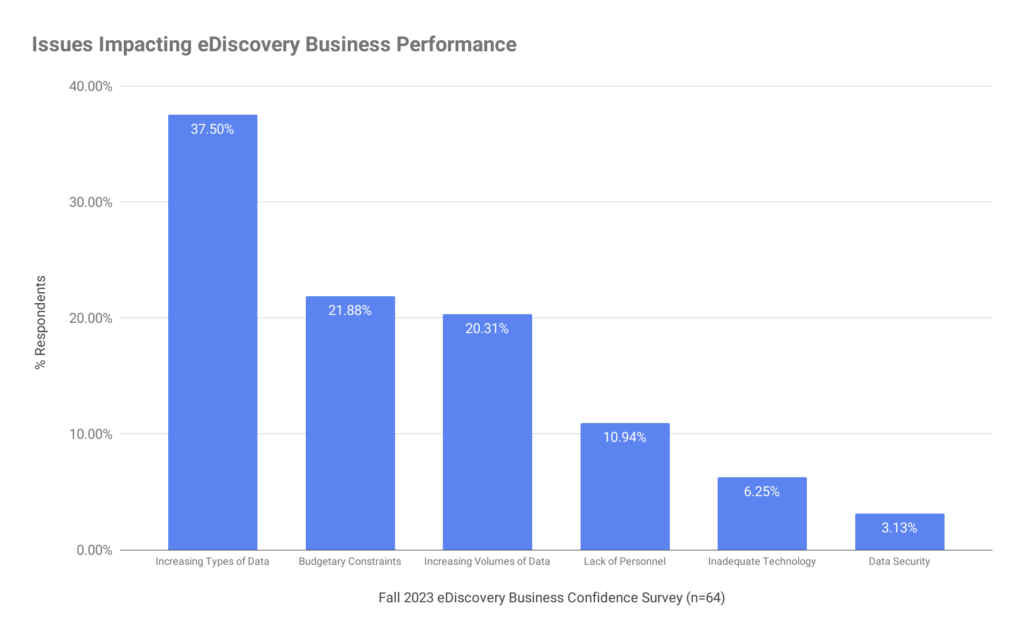

Data Volumes and Types Remain Top Challenge

- When asked about the biggest issue impacting eDiscovery business, increasing data types (37.50%) and volumes (20.31%) were two of the three top challenges selected.

- This indicates managing and deriving insights from growing data complexity continues to be a pain point.

- Other leading challenges were budget constraints (21.88%) and lack of personnel (10.94%).

Organizations should continue prioritizing data management, advanced analytics, and automation to streamline eDiscovery with data proliferating in volume and variety.

Strong Interest in Evaluating and Adopting LLMs/GAI

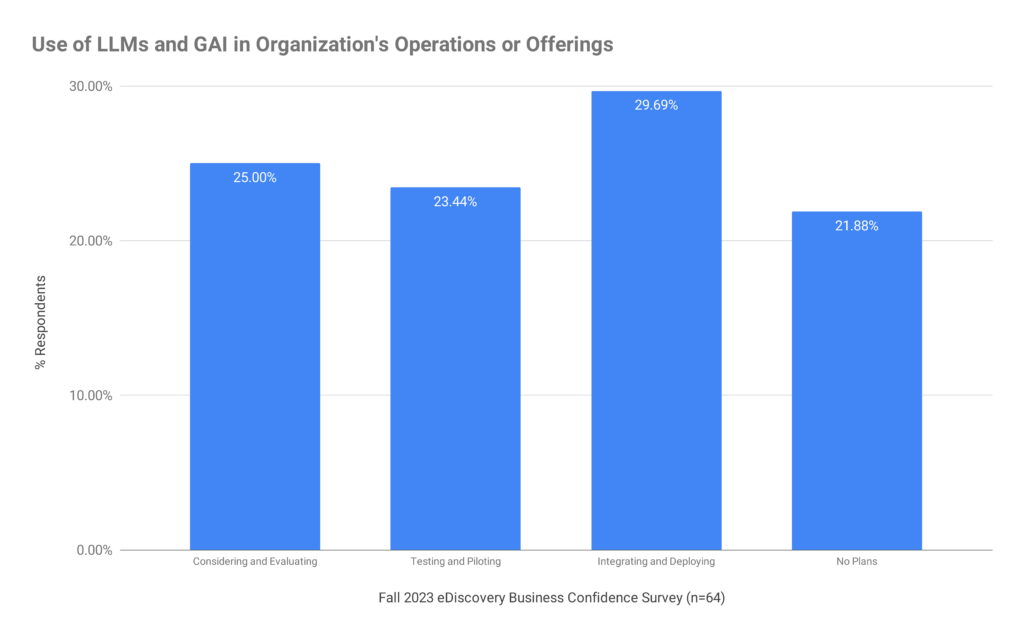

- 25.00% are considering and evaluating LLMs/GAI, while 23.44% are piloting and 29.69% actively integrating them.

- Only 21.88% have no plans for adoption.

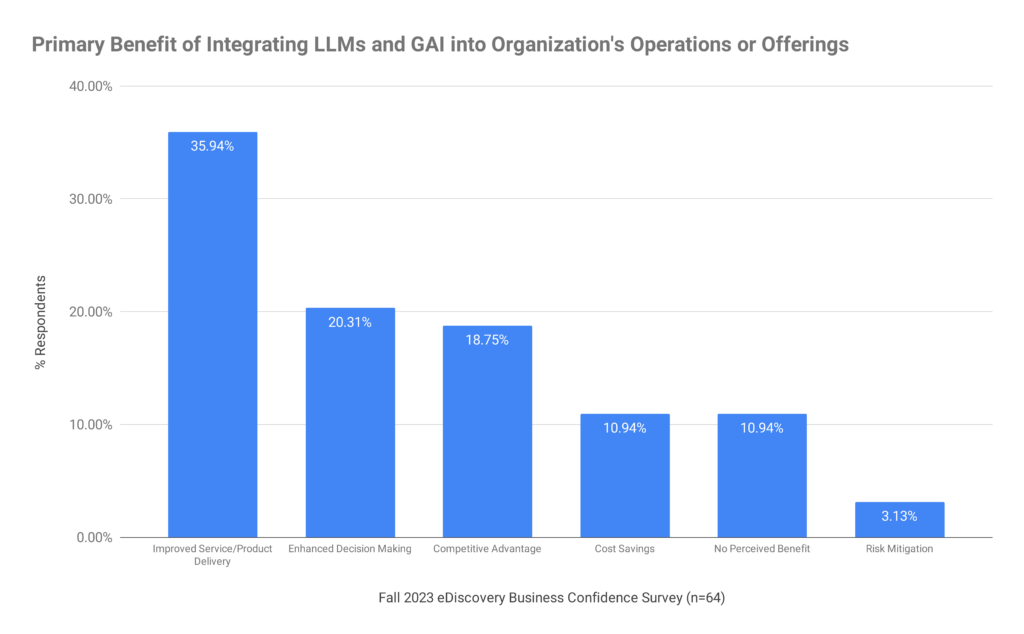

- The top perceived benefits are improved services/products (35.94%) and enhanced decision-making (20.31%).

There is significant interest in realizing the potential of LLMs/GAI, with a majority looking to leverage these technologies to enhance eDiscovery offerings. Those not pursuing adoption risk falling behind.

Concerns Remain About Accuracy, Compliance, and Skills

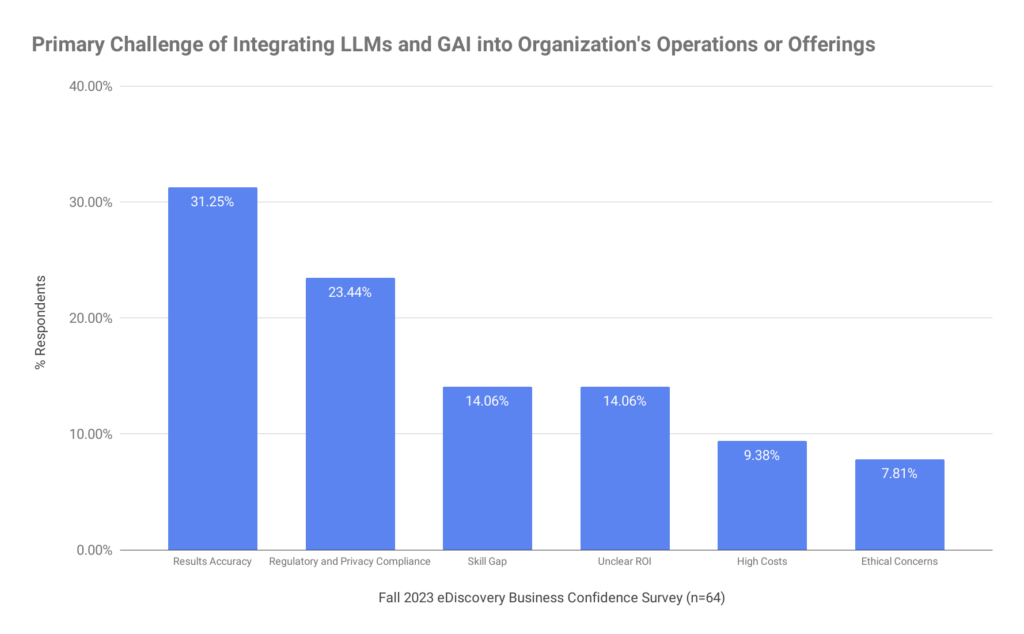

- Top LLM/GAI challenges cited were results accuracy (31.25%), regulatory/privacy compliance (23.44%), and skill gaps (14.06%).

- This shows apprehension around relying on LLMs/GAI outputs without sufficient training, validation, transparency, and human oversight.

To advance adoption, organizations must ensure proper controls, training, and workflow integration focused on augmenting rather than replacing human expertise. Multidisciplinary collaboration will be critical.

The survey paints an evolving industry cautiously moving towards leveraging AI while seeking to control risks. Those that can successfully balance innovation and responsibility may gain an edge.

This first look at the Fall 2023 eDiscovery Business Confidence Survey provides a comprehensive snapshot of the current state and future expectations within the eDiscovery industry. As the industry continues to evolve, these insights will continue to be invaluable for professionals navigating this dynamic landscape. Future analyses will delve deeper into these trends, offering a more detailed understanding of the business of eDiscovery.

Fall Survey Questions (Required)

n = 64 Respondents

Business Confidence Questions

1. Which of the following segments best describes your business in eDiscovery?

Part of the eDiscovery ecosystem where your organization resides

- Software and/or Services Provider: 43.75%

- Law Firm: 28.13%

- Consultancy: 10.94%

- Corporation: 9.38%

- Media/Research Organization: 7.81%

- Other: 0.00%

- Governmental Entity: 0.00%

2. How would you rate the current general business conditions for eDiscovery in your segment?

Subjective feeling of business performance when compared with business expectations

- Good: 46.88%

- Normal: 46.88%

- Bad: 6.25%

3. How do you think the business conditions will be in your segment six months from now?

Subjective feeling of business performance when compared with business expectations

- Better: 54.69%

- Same: 39.06%

- Worse – 6.25%

4. How would you guess revenue in your segment of the eDiscovery ecosystem will be six months from now?

Revenue is income generated from eDiscovery-related business activities

- Higher: 57.81%

- Same: 32.81%

- Lower: 9.38%

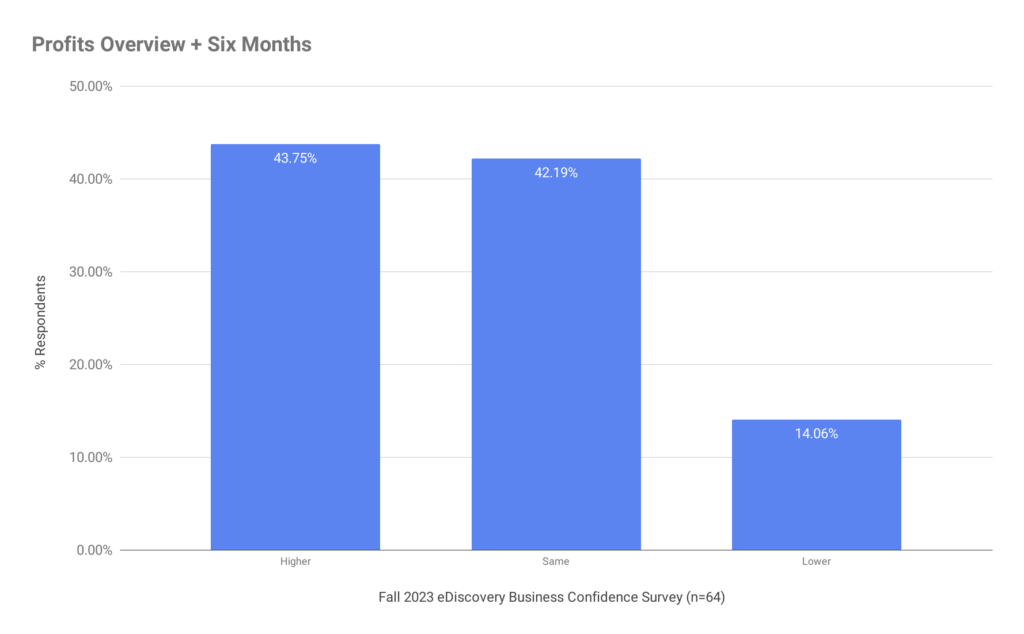

5. How would you guess profits in your segment of the eDiscovery ecosystem will be six months from now?

Profit is the amount of income remaining after accounting for all expenses, debts, additional revenue streams, and operating costs

- Higher: 43.75%

- Same: 42.19%

- Lower: 14.06%

6. Of the six items presented below, what is the issue that you feel will most impact the business of eDiscovery over the next six months?

Challenges that may directly impact the business performance of your organization

- Increasing Types of Data: 37.50%

- Budgetary Constraints: 21.88%

- Increasing Volumes of Data: 20.31%

- Lack of Personnel: 10.94%

- Inadequate Technology: 6.25%

- Data Security: 3.13%

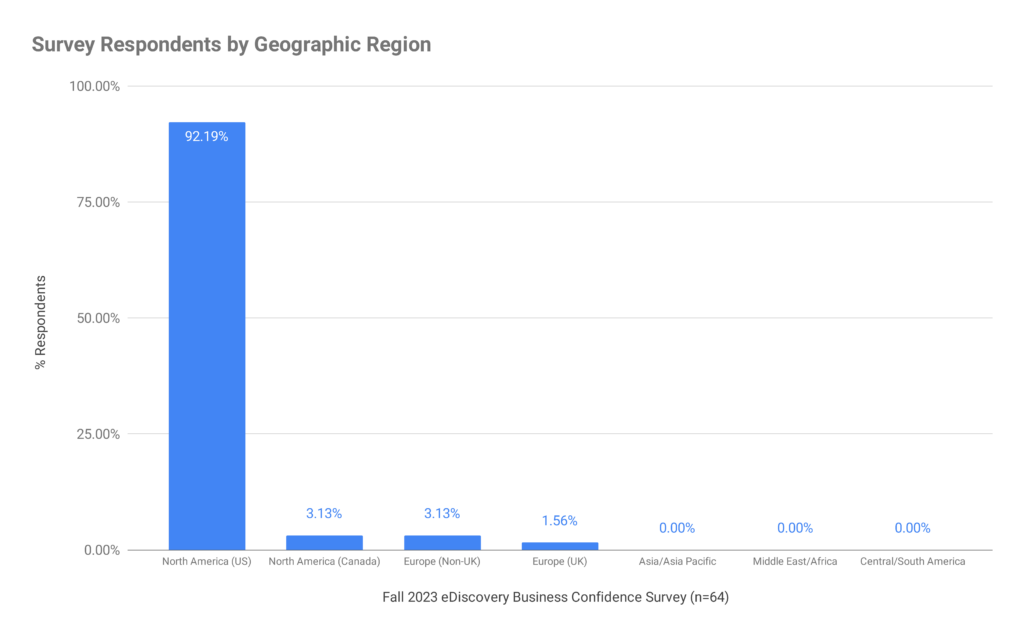

7. In which geographical region do you primarily conduct eDiscovery-related business?

The location from which you are basing your business assessments

- North America – United States: 92.19%

- North America – Canada: 3.13%

- Europe (Non-UK) – 3.13%

- Europe – United Kingdom: 1.56%

- Asia/Asia Pacific: 0.00%

- Middle East/Africa – 0.0%Central/South America – 0.0%

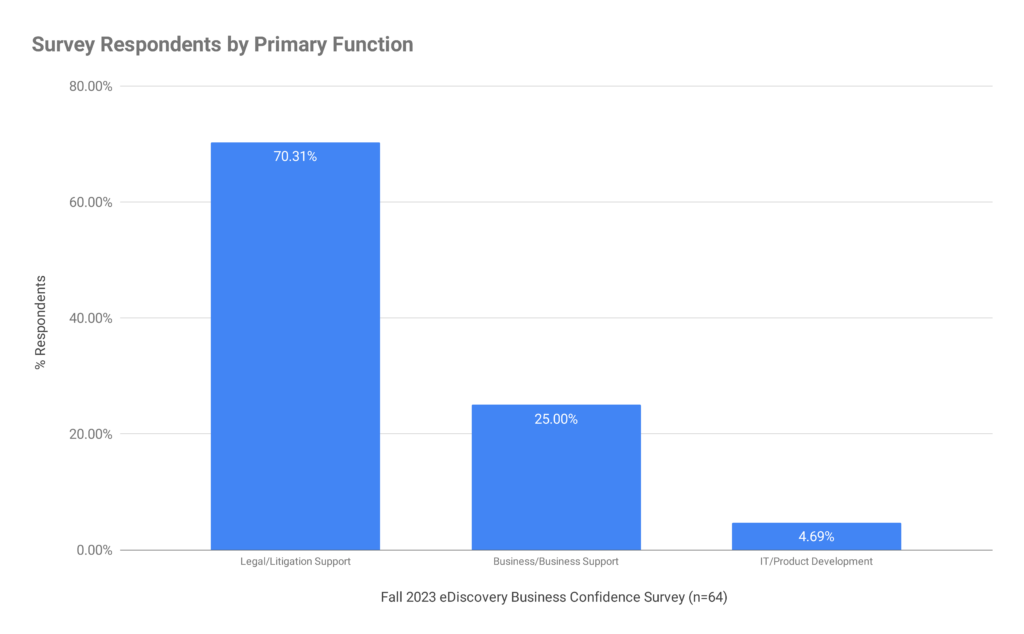

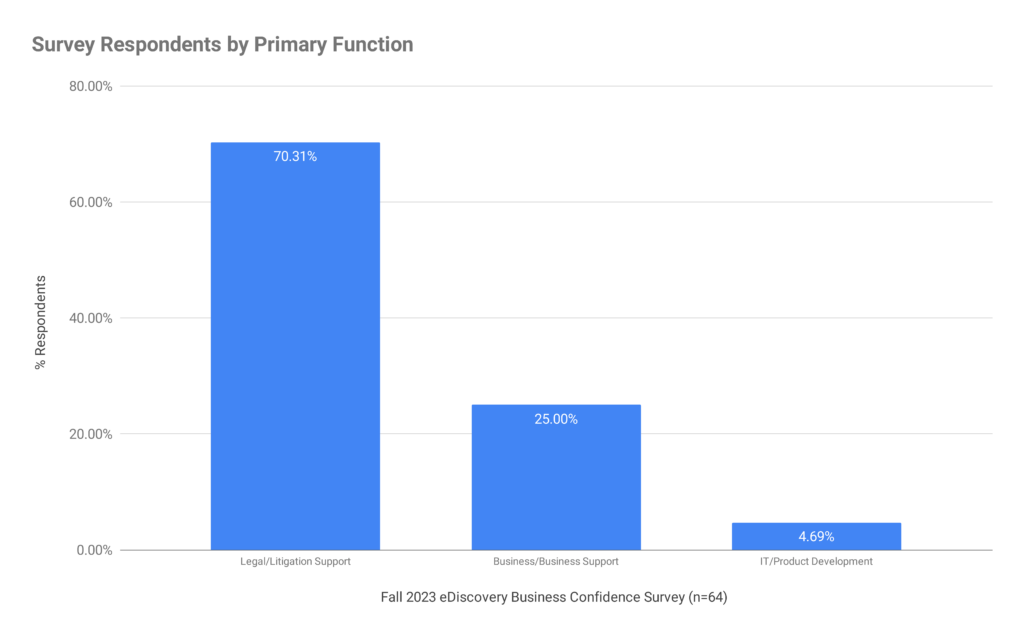

8. What area best describes your primary function in the conduct of your organization’s eDiscovery-related business?

- Legal/Litigation Support: 70.31%

- Business/Business Support (All Other Business Functions): 25.00%

- IT/Product Development: 4.69%

9. What area best describes your level of support in the conduct of your organization’s eDiscovery-related business?

- Executive Leadership: 35.94%

- Operational Management: 32.81%

- Tactical Execution: 31.25%

Large Language Models and Generative Artificial Intelligence Questions

10. How would you characterize the use of LLMs and GAI in your organization’s operations or offerings?

- Considering and Evaluating: 25.00%

- Testing and Piloting: 23.44%

- Integrating and Deploying: 29.69%

- No Plans: 21.88%

11. Of the options provided, which do you perceive as the primary benefit of integrating LLMs and GAI into your organization’s operations or offerings?

- Improved Service/Product Delivery: 35.94%

- Enhanced Decision Making: 20.31%

- Competitive Advantage: 18.75%

- Cost Savings: 10.94%

- No Perceived Benefit: 10.94

- Risk Mitigation: 3.13%

12. Of the options provided, which do you perceive as the primary challenge of integrating LLMs and GAI into your organization’s operations or offerings?

- Results Accuracy: 31.25%

- Regulatory and Privacy Compliance: 23.44%

- Skill Gap: 14.06%

- Unclear ROI: 14.06

- High Costs: 9.38%

- Ethical Concerns: 7.81%

Business Metric Trajectory Questions (Optional)

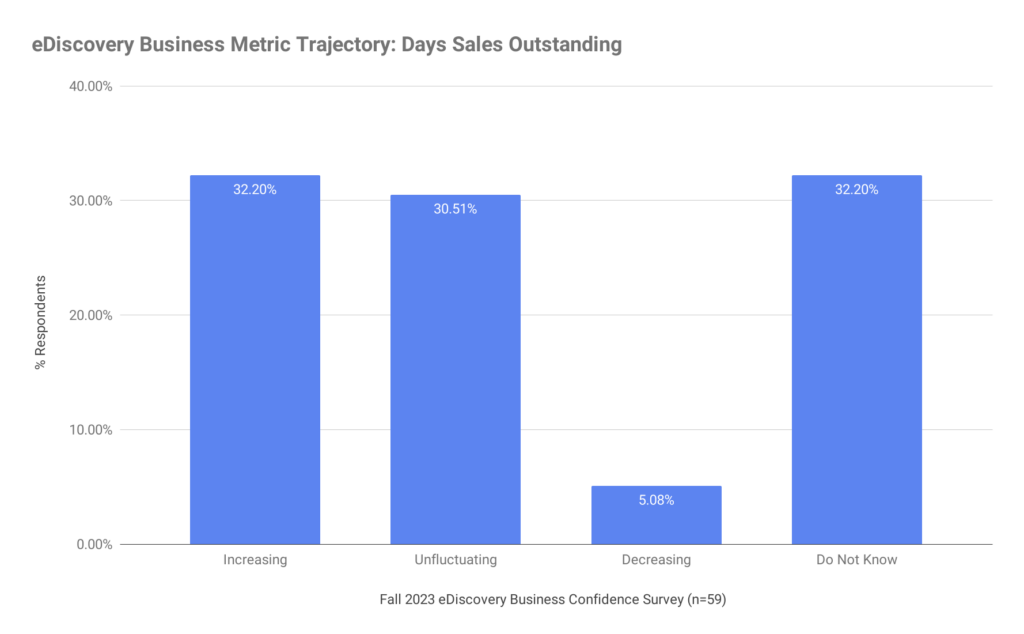

13. How would you characterize the trajectory of your organization’s Days Sales Outstanding (DSO) during the last quarter?

n=59 Respondents

- Increasing: 32.20%

- Unfluctuating: 30.51%

- Decreasing: 5.08%

- Do Not Know: 32.20%

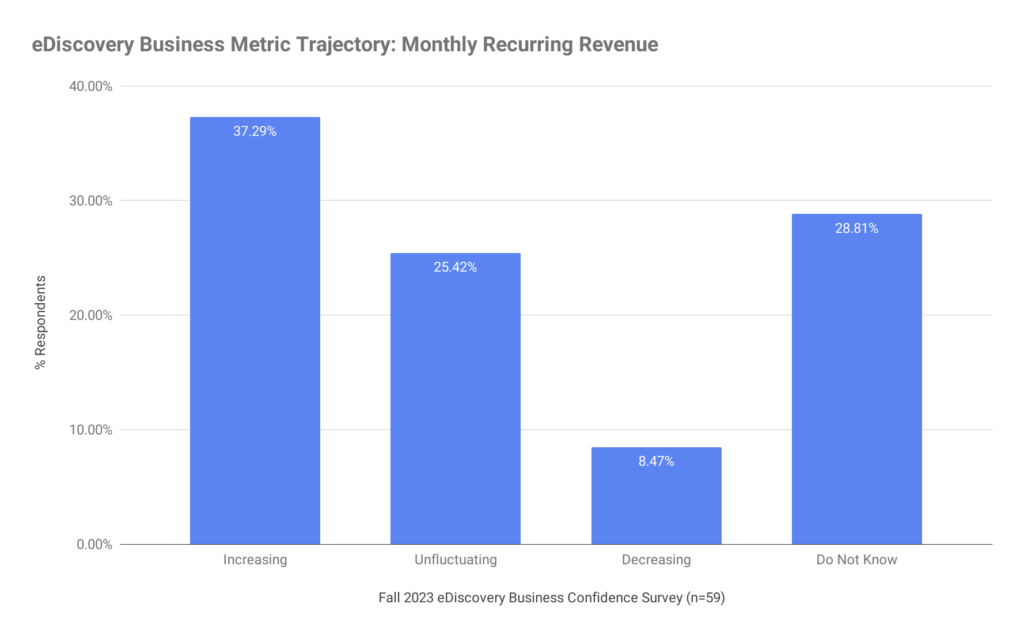

14. How would you characterize the trajectory of your organization’s Monthly Recurring Revenue (MRR) during the last quarter?

n=59 Respondents

- Increasing: 37.29%

- Unfluctuating: 25.42%

- Decreasing: 8.47%

- Do Not Know: 28.81%

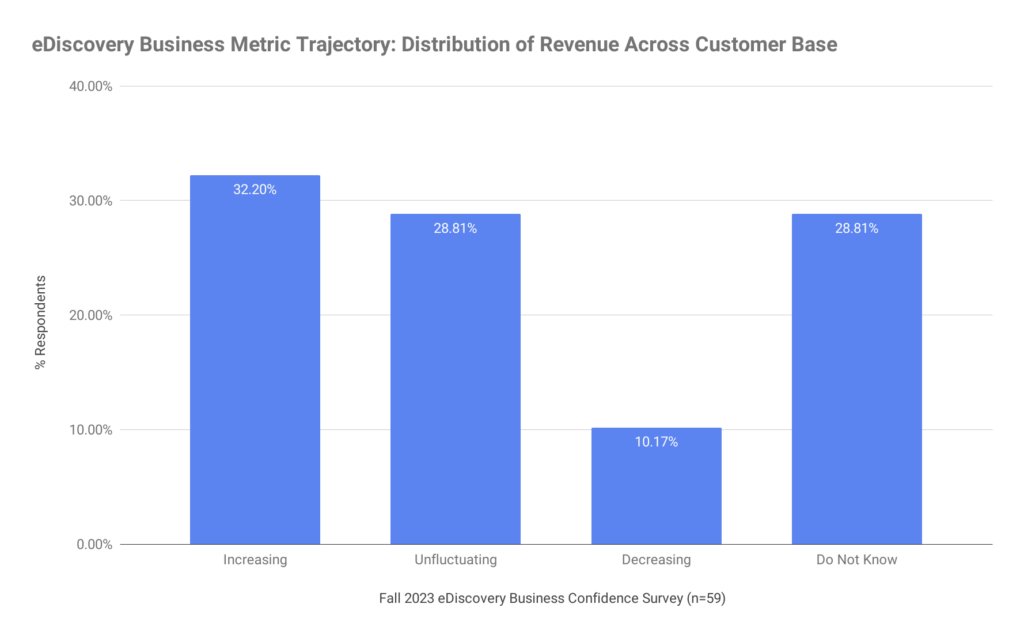

15. Which of the following statements best describes the distribution of your organization’s revenue across your customer base during the last quarter?

n=59 Respondents

- Increasing: 32.20%

- Unfluctuating: 28.81%

- Decreasing: 10.17%

- Do Not Know: 28.81%

*Survey methodology focuses on the achievement of at least 50 responses with the least number of emails sent to the ComplexDiscovery industry professional database. This approach seeks to minimize the number of requests for participation in surveys while ensuring a solid number of responses from which to generally assess market sentiment in survey areas of interest.

Respondent Backgrounder

Aggregate Surveys (Winter 2016 – Fall 2023)

Fall Surveys (Fall 2016 – Fall 2023)

0-Business-Confidence-100223

Assisted by GAI and LLM Technologies per EDRM GAI and LLM Policy.

Additional Reading

- eDiscovery Survey Archives of ComplexDiscovery

- eDisclosure Systems Buyers Guide – Online Knowledge Base

Source: ComplexDiscovery